EUR/USD Technical Highlights:

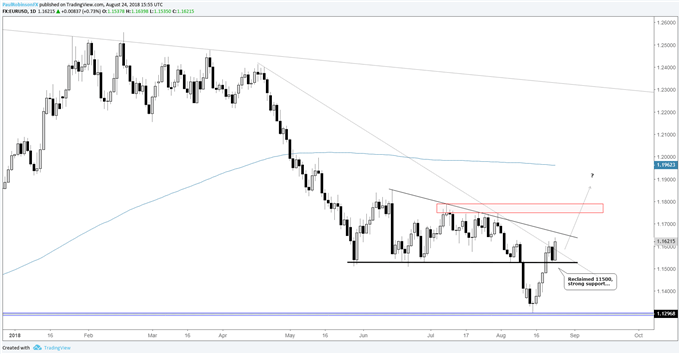

- EUR/USD reclaims important 11500 level

- Key lines lie at hand and just ahead

- Broader rally in store if no downturn soon

See what is driving EUR/USD on a fundamental basis and how the longer-term technicals look in the DailyFX Q3 Euro Forecast.

Coming into the week we were looking for digestion of recent losses to lead to an opportunity for more euro weakness shortly thereafter. Wrong. The turnaround off support near 11300 gave no signs of letting up and with it came the reclaiming of the important 11500 level.

The sharp decline and reverse out of a two month consolidation pattern smacks more of a possible trend reversal than a seller’s bounce. A break above the April trend-line and top-side trend-line of the previously broken wedge may be enough to kick into high gear a move towards the reversal camp and completely scrap the ”it’s only a bounce”thesis.

Next week, we’ll be watching to see whether the aforementioned resistance levels (lines in this case) can keep a lid on continued strength, or if indeed we may have a larger trend reversal on our hands. Even if a much larger rally is to occur, keep an eye on the numerous highs in the mid to upper-11700s as this area could prove problematic on a first touch. On any immediate weakness 11500 is viewed as strong support.

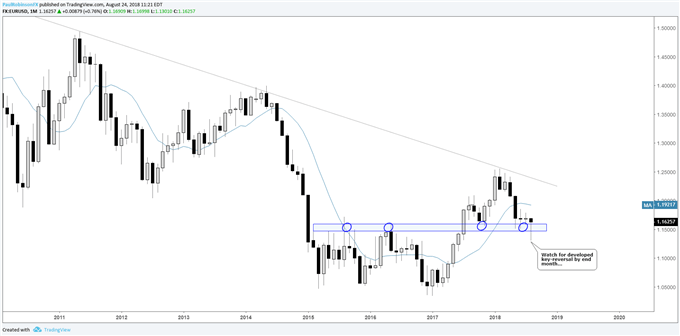

It’s too soon to count it in the books with still a week left in the month, but turning to the monthly chart a key-reversal may form with its tail jetting through long-term support. This could mark an important rejection, or inflection point. We’ll soon discuss this should the August candle maintain or improve its integrity.

Gotten a little off track? It’s happens to everyone, which is why we put together these 4 ideas to help rebuild your confidence.

EUR/USD Daily Chart (Back above 11500)

EUR/USD Monthly Chart (Key-reversal, rejection?)

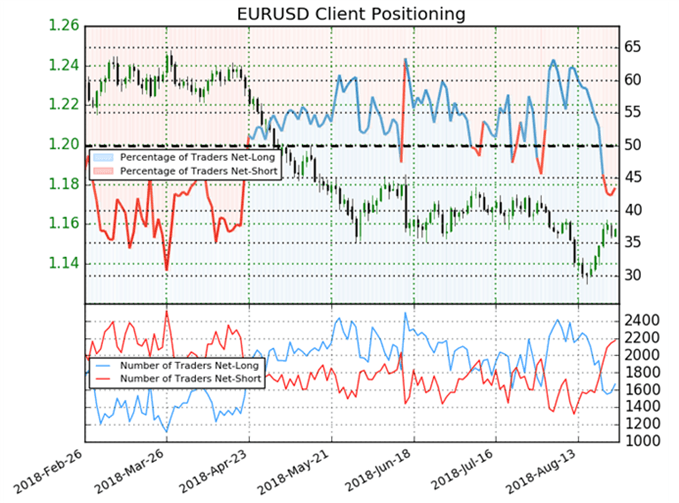

EUR/USD Sentiment

As per IGCS, traders haven’t been leaning too strongly one way or another despite some decent-sized moves the past few months. However, there has been a quick rush recently from long to short, and while this scramble hasn’t yet provided a big net figure it does suggest more upside could soon follow. For more details on the sentiment model and how it acts as a contrarian indicator, check out the IG Client Sentiment page.

EUR/USD IG Client Sentiment

Other Weekly Technical Forecasts:

AUD: Prices May Consolidate as Downtrend Remains Intact

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX