EUR/USD Technical Highlights:

- EUR/USD gets clobbered back down to support

- Looking for some back-and-filling as market digests ECB

- Overall, bias is for rallies to fail but not full-on bearish until support breaks

Whether you are looking for trading forecasts for the Euro or another currency, trade ideas, or educational guides, we’ve got you covered on the the DailyFX Trading Guides page.

On Thursday, the ECB’s cautious stance on the removal of monetary stimulus sent EUR/USD down sharply, the biggest move in recent memory. This has price support running back to 2015 and the January 2017 trend-line squarely under assault again.

The thinking on this end is that we will see some backing-and-filling in the days ahead as the market digests the impact of Thursday’s outcome. This could make for less-than-ideal trading conditions in the very near-term as the euro chops around. Overall, though, the bias right now is that any bounce from here, despite coming from support, is likely to be short-lived.

However, we will respect support for as long as it holds. But in the event we see a breakdown through the May low at 11510 (which will also have the euro trading through the Jan ’17 trend-line), then we’ll be looking for another leg lower to develop with the 11300-area in focus as possible support. Looking lower, though, there aren’t any substantial levels of support catching our attention.

Even the best traders go through tough times. Check out these 4 ideas for building confidence.

EUR/USD Daily Chart (Holding support – for now)

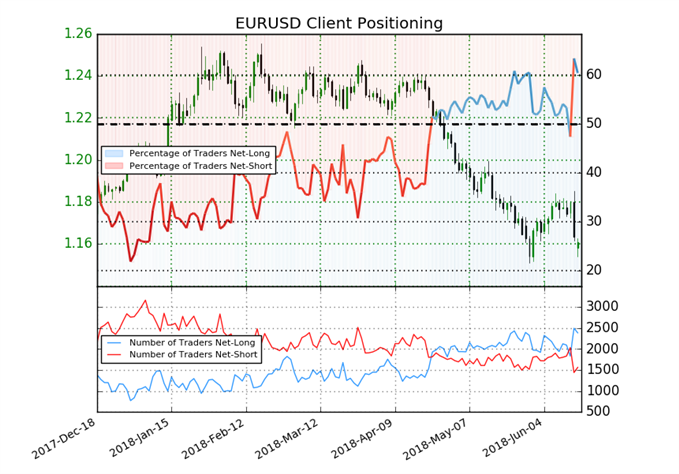

EUR/USD IG Client Sentiment (Net-long Rockets Higher)

As per IG Client Sentiment, retail traders went from net-short just before Thursday to as long as they’ve been in at least 6-months. As a contrarian indicator this sharp scramble is viewed as bearish, and should the long figure remain stubbornly high while price fails to rally, it could be an indication that the euro wants to trade lower at some point relatively soon.

EUR/USD IGCS

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX