EUR/USD Technical Highlights:

- EUR/USD held onto long-term support last week from back to 2015

- Outlook is neutral at worst, tentatively bullish as long as last week’s low holds

For the intermediate-term fundamental and technical outlook on EUR/USD, check out the DailyFX Forecast.

The precipitous decline in the euro may have come to an end, at least for now. After briefly declining beneath the November low into levels carved out during 2015/16, buyers stepped in aggressively on Wednesday. A trend-line rising up from January 2017 is also in confluence with long-term price support.

On the weekly chart, the euro tried to put in a modestly bullish reversal bar, but it’s certainly not of the high-conviction variety. Perhaps we will see a bit of early-week weakness in the euro, but as long as last week’s low at 11510 holds, then the outlook is neutral at worst, tentatively bullish for a recovery bounce.

A break below support will be reason for abandoning a bullish bias and working with the continued trend lower. It’s a bit of a tricky spot down here, but, again, there is a solid floor at the euro’s feet to work with in the days ahead.

Resistance by way of a few lows from last year will need to be cleared on the daily time-frame to garner top-side momentum; over 11760 should be enough to bolster buyers into pushing EUR/USD higher.

Even the best traders go through tough times. Check out these 4 ideas for building confidence.

EUR/USD Weekly Chart (Reversal at support)

EUR/USD Daily Chart

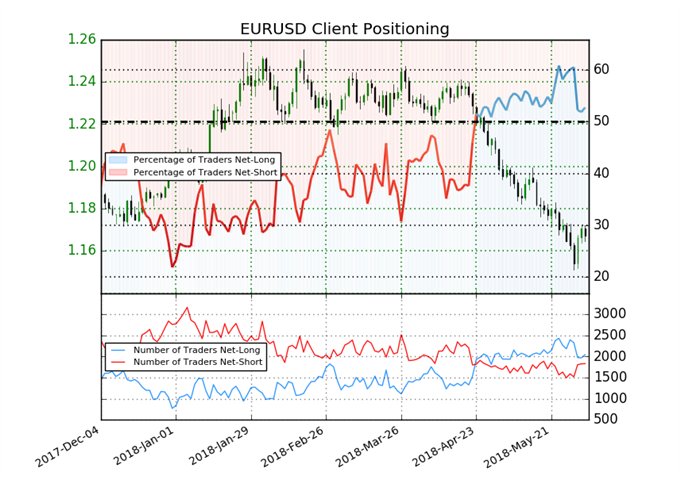

Traders haven’t been taking a strong stance one way or another in EUR/USD as per IGCS Client Sentiment, not like they have in other pairs which have made large one-way moves recently (i.e. GBP/USD). But continue to monitor the situation as we trade around this pivotal area. Should we see a sudden the recent spike lower in net-longs (longs sell, shorts cover) continue, it could bolster the case for further gains.

EUR/USD IGCS

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX