Currency Volatility NZD Talking Points

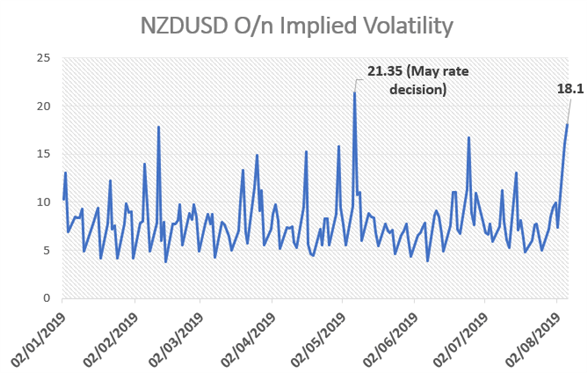

- NZDUSD overnight implied volatility highest since May

- Risk reversals suggest firm demand for downside protection

Top 10 most volatile currency pairs and how to trade them

For a more in-depth analysis on FX, check out the Q3 FX Forecast

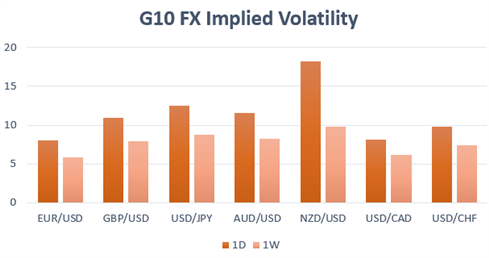

NZD Expected to be the Most Volatile Currency

NZDUSD | Across the G10 complex the New Zealand Dollar is expected to be the most volatile currency as market participants await the RBNZ rate decision. This also comes amid the deteriorating sentiment in regard to the US-Sino trade tensions which has also kept volatility notably elevated. Overnight implied vols have jumped to 18.1 vols, which is the highest since the May rate decision. This implies that NZDUSD ATM break-evens = 49pips (meaning that option traders need to see a move of at least 49pips in either direction in order to realise gains). At the same risk reversals continue to show demand for downside protection, although this has eased slightly from -1.225 to -0.925.

The RBNZ rate decision is scheduled for 0300BST (2200EST), where money markets are pricing in a 100% chance that the RBNZ will lower interest rates by 25bps to 1.25%. As such, with the rate decision a foregone conclusion eyes will be on the accompanying statement and whether the central bank signals another rate cut before the year-end. As it stands, money markets attach a 92% chance of an additional rate cut by November.

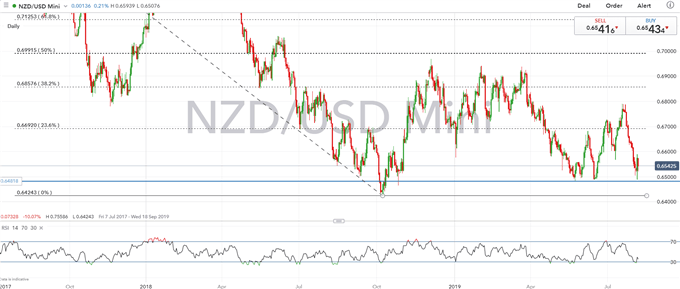

NZDUSD Price Chart: Daily Time Frame (Jul 2017 – Aug 2019)

On the technical front, firm support remains situated at 0.6480-90, as such a dovish reaction to the RBNZ statement could see this tested once more. However, any signals that another cut may not be on the cards throughout the rest of the year, upside risks could see a test of the psychological 0.6600 handle.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX