CAD Analysis and Talking Points

- USD/CAD | Key Support Situated at Range Low

- CAD/JPY | Outlook Constructive as Momentum Tilts Bullish

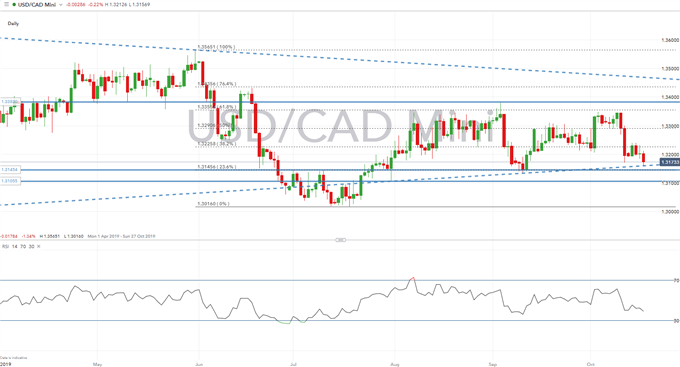

USD/CAD | Key Support Situated at Range Low

USD/CAD trades on the defensive with the pair below the 1.32 handle, which in turn is now hovering around last weeks low of 1.3170. Momentum indicators (signalled via DMI) tilts to a bearish bias, thus raising the likelihood the USD/CAD will continue to trend low. Key support is situated at 1.3145, which represents the lower bound of the range that has been in place since the end of July. As such, a closing break below paves the way for a move towards 1.31. On the topside, resistance resides at 1.3230-40, which also coincides with the 100DMA.

USD/CAD Price Chart: Daily Time Frame (Apr 2019 – Oct 2019)

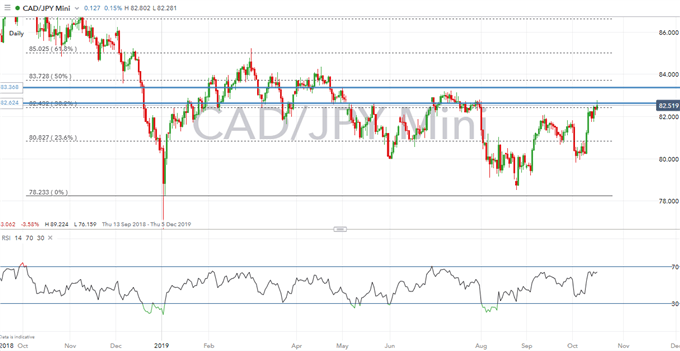

CAD/JPY | Outlook Constructive as Momentum Tilts Bullish

Following the push above all key moving averages (50,100 and 200 day), the outlook for the cross is somewhat constructive with momentum indicators also pointing towards further gains. While resistance at 82.50 is curb upside, a continued lift in risk sentiment could propel the cross back towards 83.00-20.

CAD/JPY Price Chart: Daily Time Frame (Sep 2018 –Oct 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX