GBP Analysis and Talking Points

- GBP/USD| Beware of Brexit Induced Volatility

- EUR/GBP | Lacking Clear Directional Bias Since 200DMA Bounce

See the DailyFX FX forecast to learn what will drive the currency throughout the quarter.

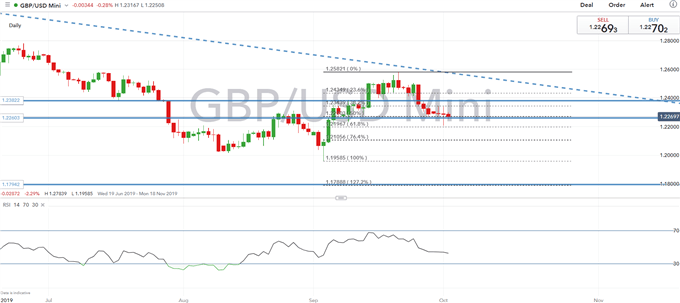

GBP/USD | Beware of Brexit Induced Volatility

Momentum indicators on the daily time frame remain tilted to the downside, however, beware of Brexit induced volatility, which will leave the pair vulnerable to sudden spikes. The pair has found support this morning from the 50DMA situated at 1.2253, however, scepticism over Boris Johnson’s Brexit plan could see this level tested once more and opening the door for a move towards the 1.22 handle. That said, on topside the weekly high (1.2346) has so far capped upside in the pair this week.

GBP/USD PRICE CHART: Daily Time Frame (Jun 2019 – Oct 2019)

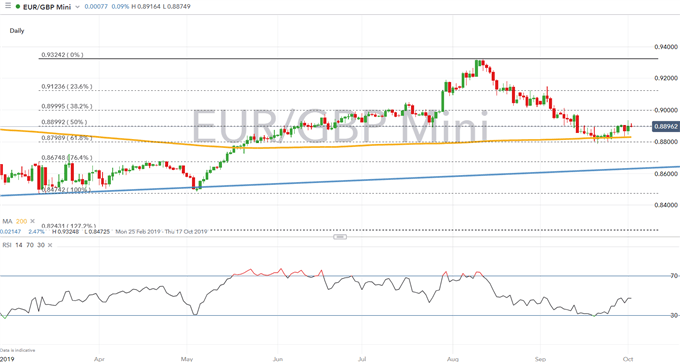

EUR/GBP | Lacking Clear Directional Bias Since 200DMA Bounce

EUR/GBP has continued to edge higher, reclaiming the 0.8900 handle following the bounce back from the 200DMA (0.8832). However, with that said, momentum indicators are somewhat mixed thus lacking a clear directional bias, which has also been reaffirmed by the dip in trend signals. On the topside, resistance is situated at 0.8969, which marks the 100DMA. As a reminder, given the heightened headline risk surrounding Brexit with Boris Johnson set to unveil his Brexit plans at the Conservative party conference, EUR/GBP is likely to experience a bout of volatility, as such, a directional bias may be found after the event.

EUR/GBP Price Chart: Daily-Time Frame (Feb 2019 – Oct 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX