Equity Analysis and News

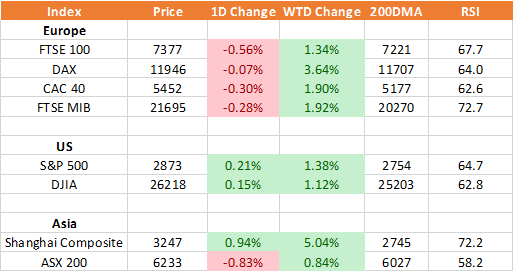

Source: Thomson Reuters, DailyFX

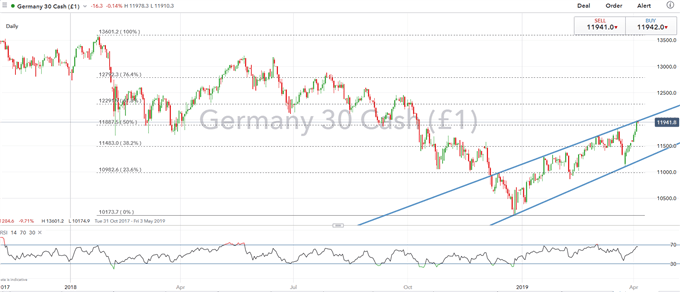

DAX | Encouraging Chinese Data Sparks a Rebound

A strong week for the DAX thus far, which has gained over 3.5% with the index underpinned at the beginning of the week following encouraging data out of China whereby the manufacturing sector moved back into expansionary territory. As a reminder, German companies and in particular the auto sector have a large exposure to China. Alongside this, upbeat PMI figures throughout the Eurozone alleviated fears that the weakness in the manufacturing sector is spreading the whole economy as the services sector picked up. However, with the DAX approaching the top of the channel and the relative strength index is nearing overbought territory, which in turn may see the psychological 12000 out of reach in the near-term.

DAX PRICE CHART: DAILY TIME FRAME (Jul 2018 – Apr 2019)

S&P 500 | Negative Divergence, Pullback in Order?

The S&P 500 has continued to grind higher with the index posting a 1.2% gain so far this week. However, warning signs are beginning to emerge technically with the relative strength index posting a negative divergence, which in turn raises the risk of a near-term pullback. Tomorrow’s NFP is not expected to provide much in the way of volatility, particularly after the Fed signaled that they would not raise interest rates this year. Eyes therefore are focused on the developments regarding trade wars, a deal is needed for another leg higher.

S&P 500 Price Chart: Daily Time Frame (Jul 2018 – Apr 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX