Equity Analysis and News

- S&P 500 | Upside Momentum Slowing as 2800 Nears

- DAX | Bearish Divergence and 11500 Curbs Further Gains

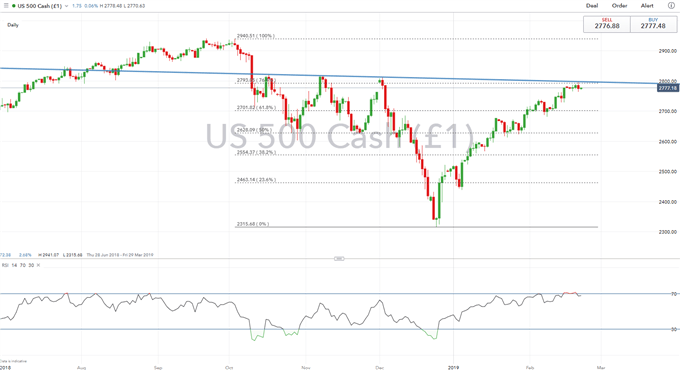

S&P 500 | Upside Momentum Slowing as 2800 Nears

As the S&P 500 edges towards key topside resistance at 2800, momentum has slowed with this week see the index somewhat range-bound, suggesting that the corrective move higher since the 2018 lows could be somewhat exhausted. As such, with the 76.4% Fibo level and 2800 holding thus far, there is a risk of a near-term pullback. Near-term support at 2730-40.

S&P 500 Price Chart: Daily Time Frame (Jun 2018 – Feb 2019)

How to Trade S&P 500 Index: Strategies, Tips & Trading Hours

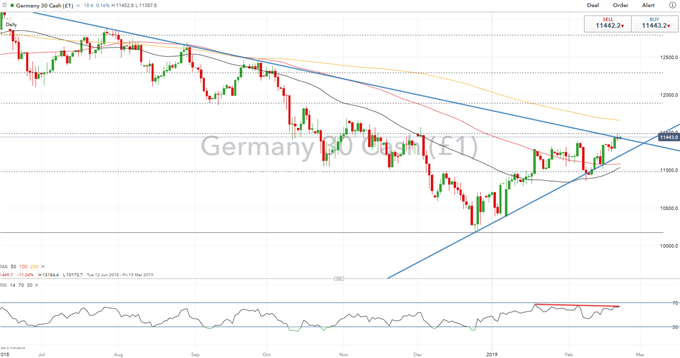

DAX | Bearish Divergence and 11500 Curbs Further Gains

Following the corrective bounce from the rising trendline, the DAX is now hovering around resistance at 11480-11500, which could curb further advances in the index. As such, a hold below 11500 continues to keep the outlook bearish for the DAX. Alongside this, the bearish RSI divergence on the daily timeframe raises scope for a pullback in the index.

DAX Price Chart: Daily Time Frame (Jun 2018 – Feb 2019)

How to Trade Dax 30: Trading Strategies and Tips

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX