COT Report: Analysis and Talking Points

- GBP Long Positions Liquidated, USD Bullish Bets at Fresh Multi-Year Highs

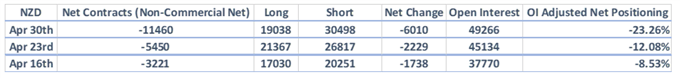

- New Zealand Dollar Net Shorts Doubled

The Predictive Power of the CoT Report

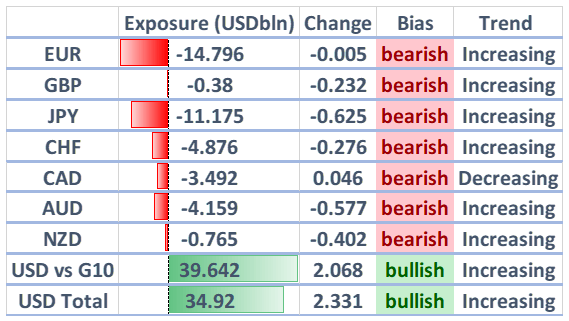

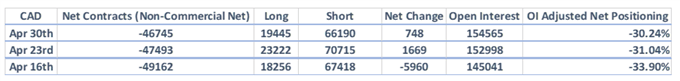

Source: CFTC, DailyFX (Covers up to April 30th, released May 3rd)

New Zealand Dollar Net Shorts Double, Speculators Liquidate GBP Long Positions

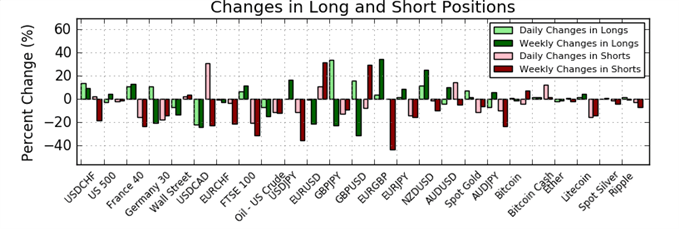

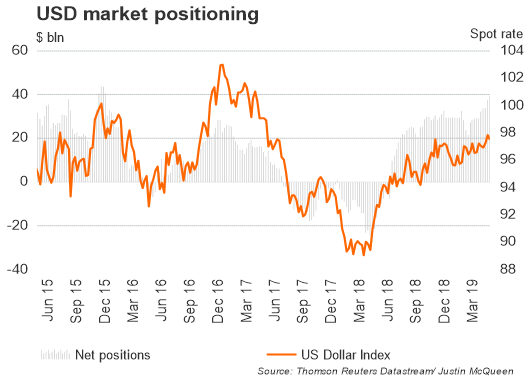

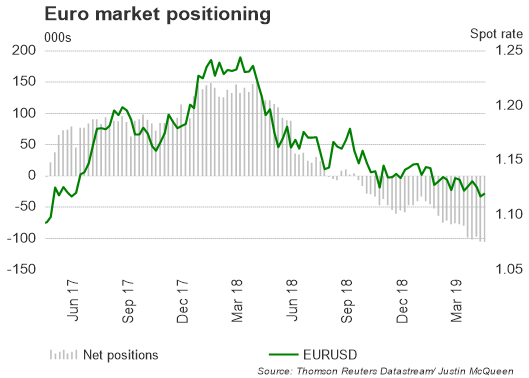

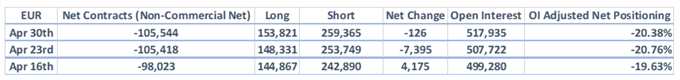

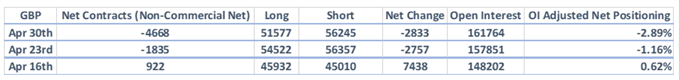

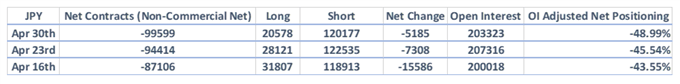

Investors continued to increase their net long exposure in the USD index with the bullish positioning yet again hitting a fresh multi-year high to near $40bln vs. G10 currencies. Broad based increases in net short positioning had contributed to the rise in USD bullish bets and most notably from an increase in JPY net shorts. Speculative JPY shorts now outweigh JPY longs by 5.8:1 (Prev. 4.3:1). Bearish Euro positioning continues to make up the bulk of USD longs, although the net chance in positioning had been relatively muted with speculators raising both gross longs & shorts.

- Latest Gross short (259k), 2015 peak (271k), 2016 peak (267k)

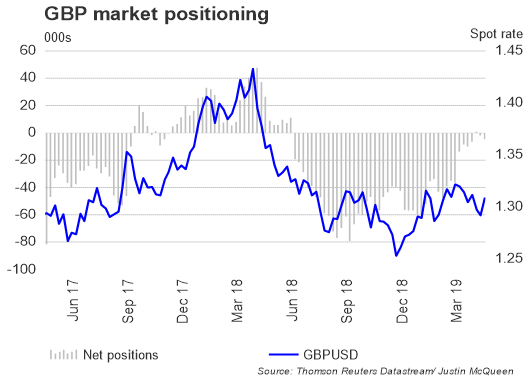

GBPUSD net short positioning increased by $232mln, however, this had largely been from a liquidation of Sterling longs. Overall positioning remains slightly neutral.

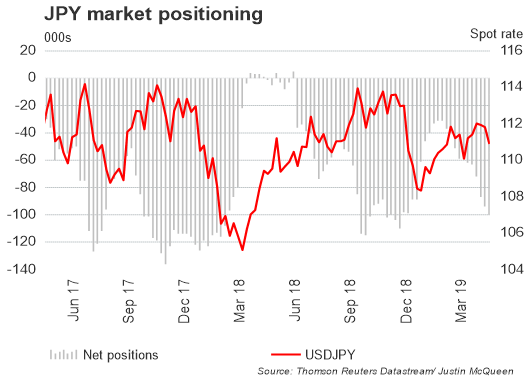

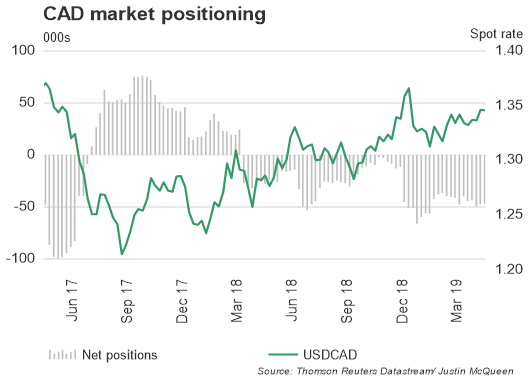

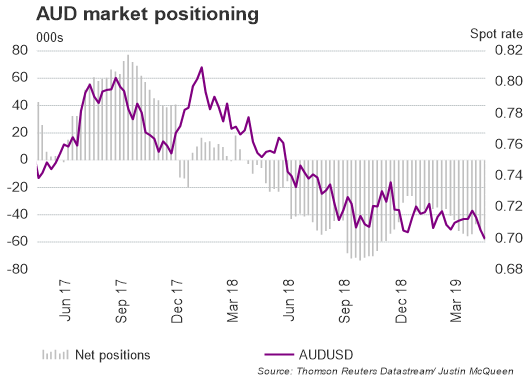

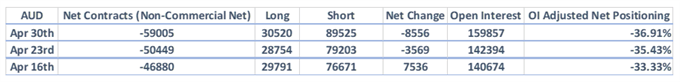

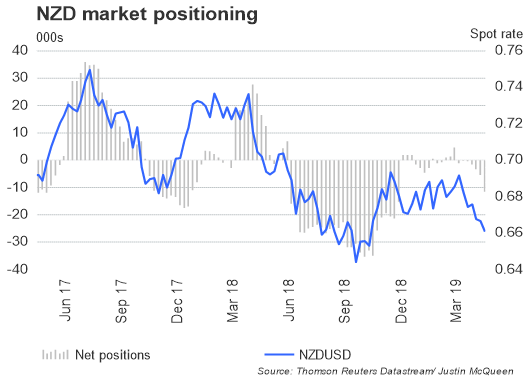

Commodity Currencies (CAD, AUD, NZD): Net short positioning in the New Zealand Dollar has doubled over the past week, totalling $765mln as speculators increase gross shorts and liquidate gross longs. Given this notable rise in NZD net shorts, a decision by the RBNZ to keep rates unchanged will likely see a sizeable short squeeze in the Kiwi.

IG CLIENT POSITIONING

IG client data shows 70.5% of traders are net-long with the ratio of traders long to short at 2.39 to 1. In fact, traders have remained net-long since Apr 02 when NZDUSD traded near 0.67808; price has moved 2.5% lower since then. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us astronger NZDUSD-bearish contrarian trading bias.

US Dollar

GBPUSD

NZDUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX