COT Report: Analysis and Talking Points

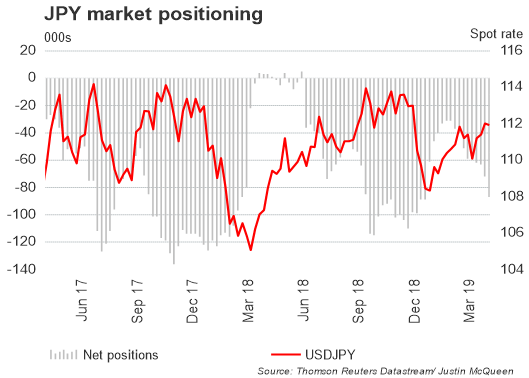

- Large Addition to JPY Net Shorts Boost Aggregate USD Long Positioning

- Speculators Net Long on GBP for the First Time Since June 2018

The Predictive Power of the CoT Report

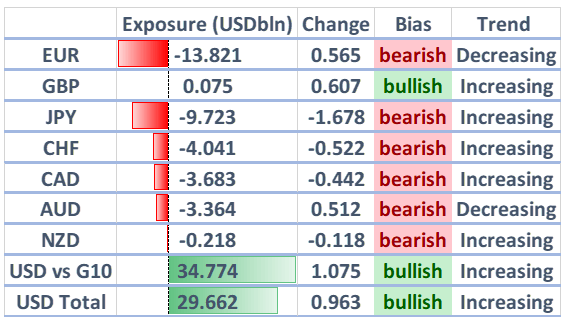

Source: CFTC, DailyFX (Covers up to April 16th, released April 19th)

Large Addition to JPY Net Shorts Boost Aggregate USD Long Positioning

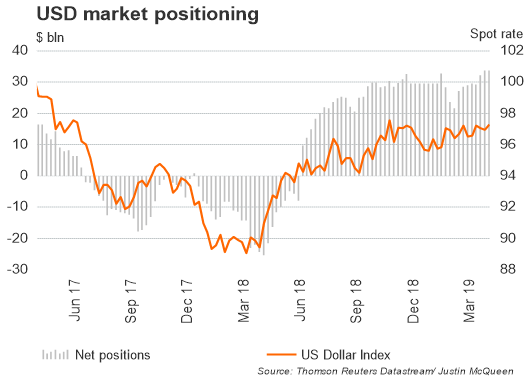

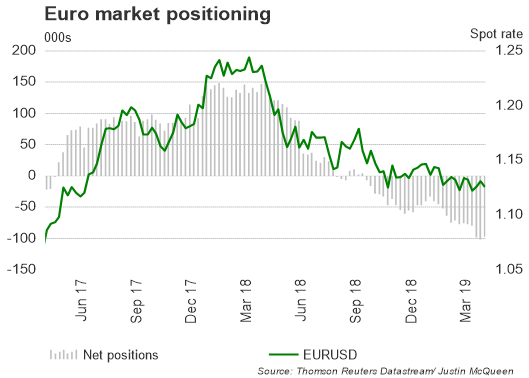

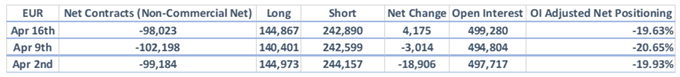

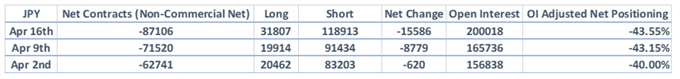

Bullish bets in the USD rose by $1bln after a sizeable increase in net short positioning by $1.7bln in JPY net shorts. Elsewhere, bearish bets on the Euro eased slightly as speculators added to its gross long positions, however, both the Euro and Japanese Yen remain the largest net shorts in the G10 space.

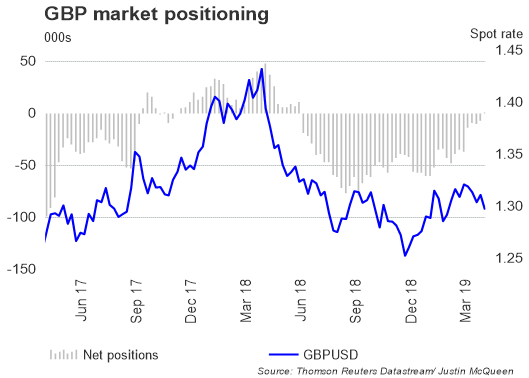

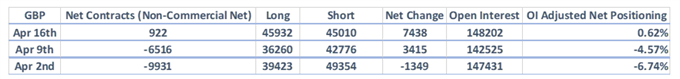

GBP net positioning have switched to net long for the first time since June 2018 with gross longs at the highest since September 2018. Much of this short squeeze had been fueled by the reduced risks of the UK leaving the EU without an agreement. However, with that said, gains for the Pound could be somewhat limited given that the currency is unlikely to find much relief from a potential short squeeze.

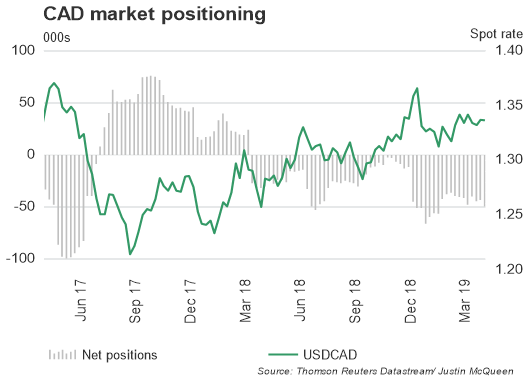

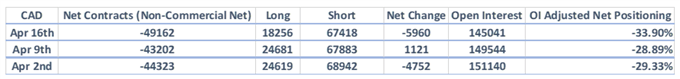

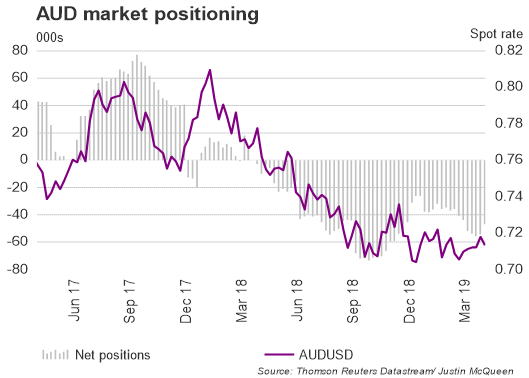

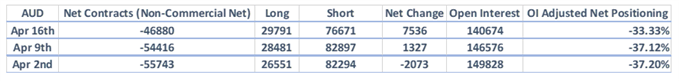

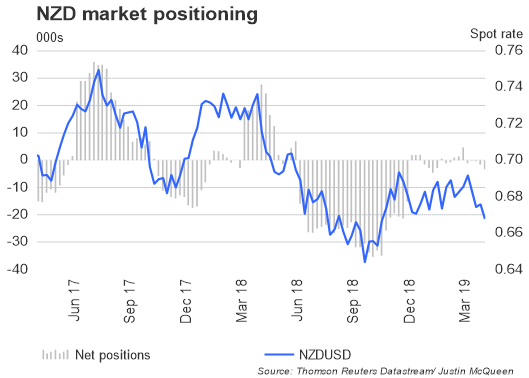

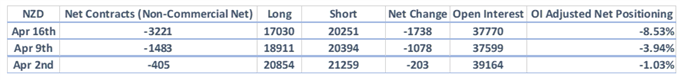

Commodity Currencies (CAD, AUD, NZD): Positioning in the Kiwi remains relatively neutral, although with expectations on the rise for a RBNZ rate cut, bearish bets on NZDUSD may rise in the near-term. Elsewhere, AUD shorts have eased amid the pick-up in Chinese data, which in turn favours further upside in AUDNZD.

US Dollar

NZDUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX