CoT Highlights:

- Silver large speculators increase net-long by record amount, price collapses

- Little information in the short-term, but interesting long-term developments

- Large speculator positioning changes in major markets/currencies

For a timelier indicator of sentiment in major currencies and markets, see the IG Client Sentiment page.

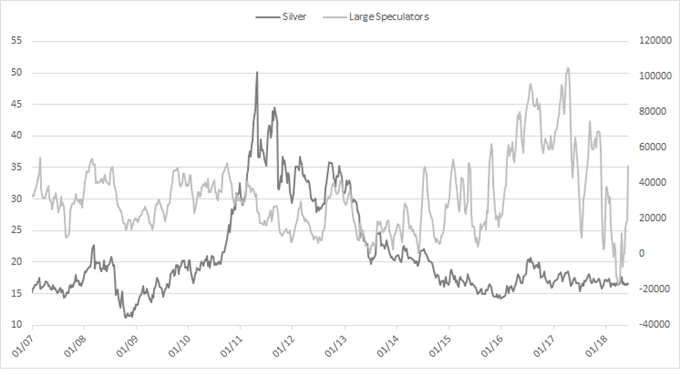

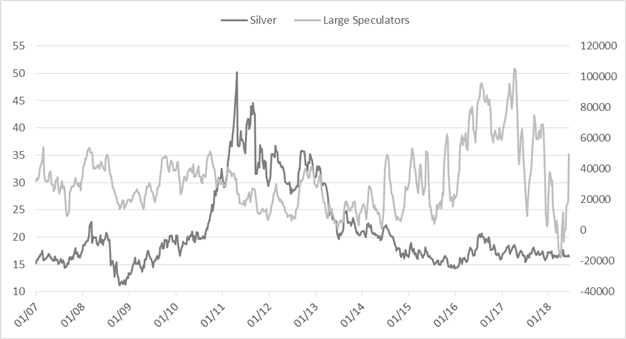

Last week, we saw the most dramatic change in speculative positioning on record in the silver market, which may not have any meaning short-term, but continues to highlight a curious relationship between price and positioning that could soon have major implications.

Every Friday the CFTC releases an overview of traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below we’ve outlined key statistics in the category of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders typically employ trend-following strategies. When analyzing the data, we take into consideration the direction of their position, magnitude of changes, as well as extremes.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

Silver large speculators increase net-long by record amount, price collapses

In the most recent reporting period, the net-long held by large speculators swelled by 30.3k contracts, topping the prior record weekly change of -27.4k contracts seen back in December. The report shows positions through last Tuesday, prior to the Wednesday/Thursday rise (which likely saw more aggressive buying) and before Friday’s sharp decline, which effectively wiped out all fresh buying we have seen during the reported period.

Chart 1 – Silver Positioning

Little information in the short-term, but interesting long-term developments

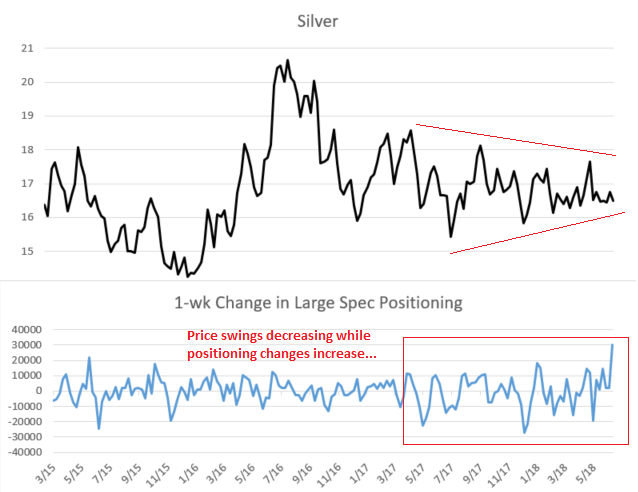

So what does this mean? Other than some untimely new longs and short covering, not a whole lot at the immediate moment with price continuing to funnel towards the apex of a wedge formation.

However, what is interesting – Since around March of last year there has been a sizable uptick in the volatility of positon changes relative to price swings in silver. Traders are becoming restless as silver continues to coil up into a wedge formation – a big move could be on the horizon.

Chart 2 – Silver price swings decreasing while positioning volatility rises

The apex of the wedge dating back to the spring of last year suggests we should see a move develop within the next couple of months. We’ll need to be patient until we see traction gained outside of the wedge, but it could be a monster move once it starts to grow legs.

Chart 3 – Silver Weekly Chart (Apex of triangle nearing)

As the second half of the year closes in, see how sentiment could tie in with the Top Trading Opportunities in 2018

Large speculator positioning profiles:

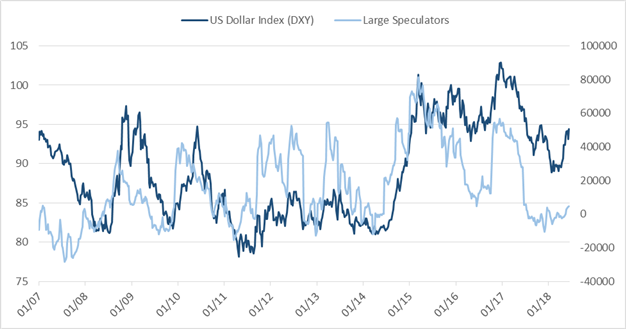

US Dollar Index (DXY)

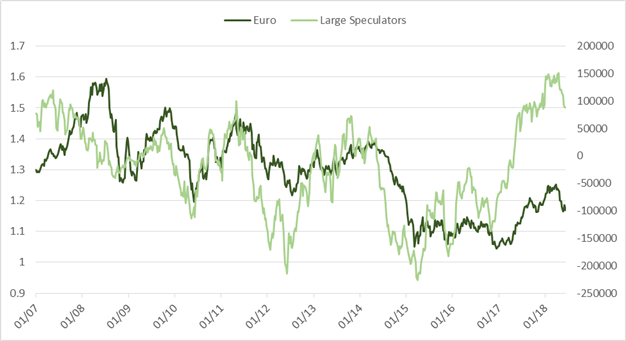

Euro

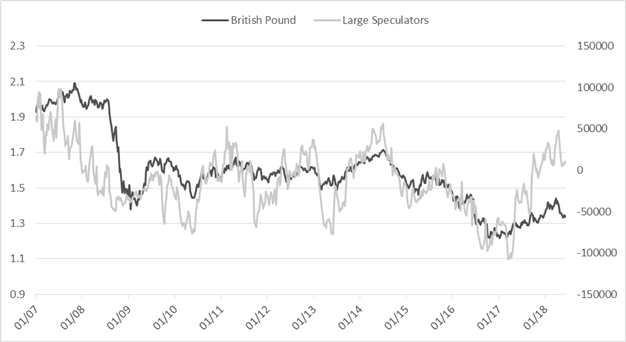

British Pound

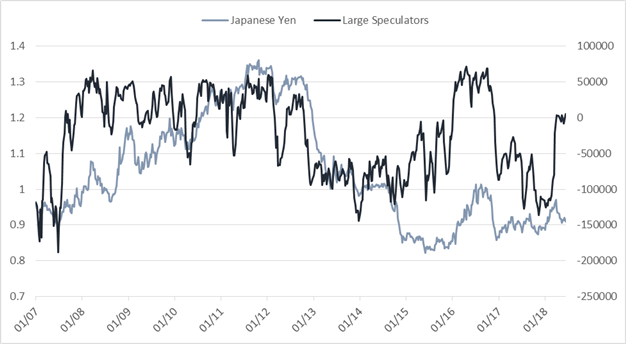

Japanese Yen

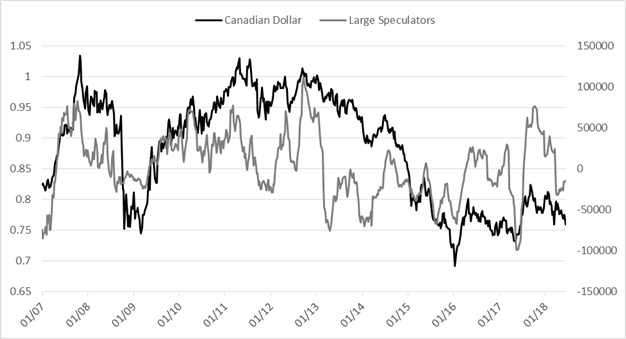

Canadian Dollar

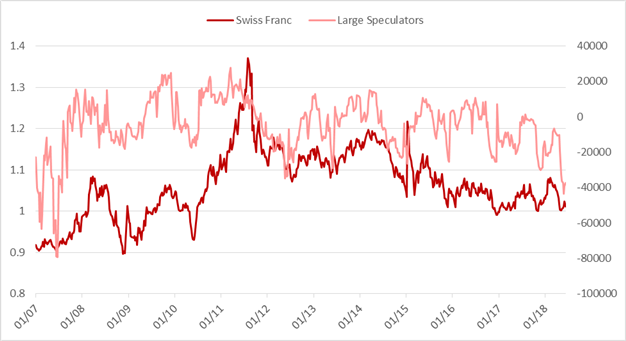

Swiss Franc

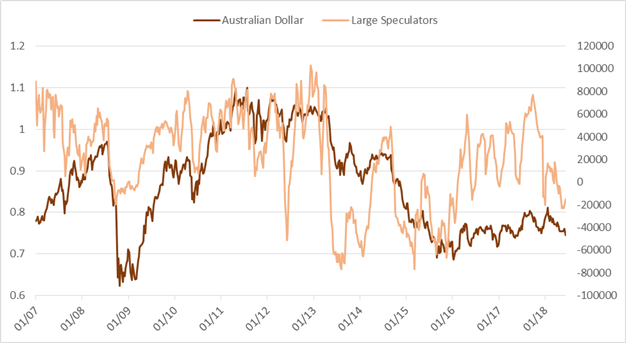

Australian Dollar

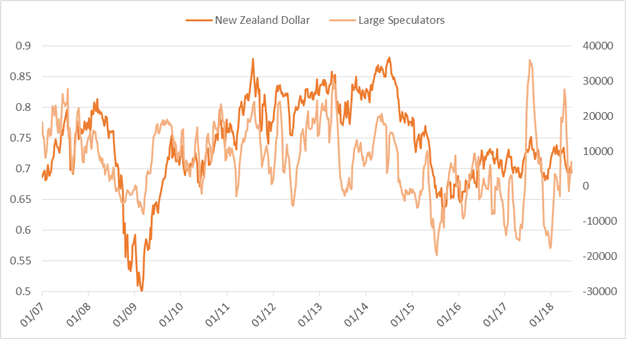

New Zealand Dollar

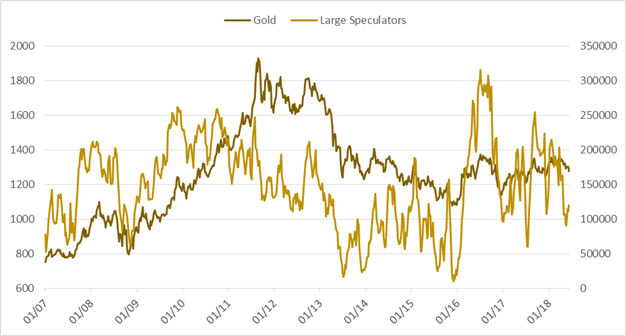

Gold

Silver

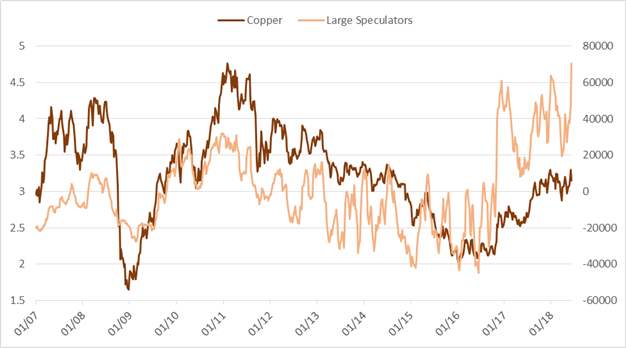

Copper

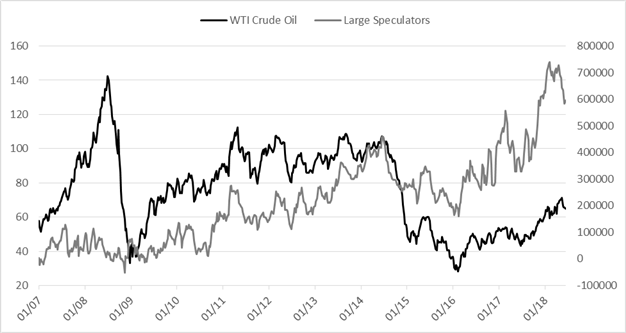

Crude Oil

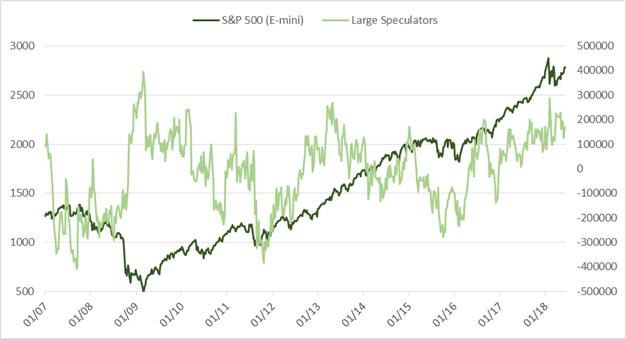

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX