CoT Highlights:

- Swiss franc large speculators shortest since June 2012

- Sharp moves in positioning have marked turns in the currency

- Sentiment plus technical backdrop bolsters case for USD/CHF decline

For a measure of short-term sentiment readings, see the IG Client Sentiment page.

Looking at the most recent CoT report, there are a few noteworthy changes with USD making such a large move recently. One of the most pronounced changes happened in the Swiss franc, and when you couple the position change with the technical backdrop, USD/CHF is postured for a set-back.

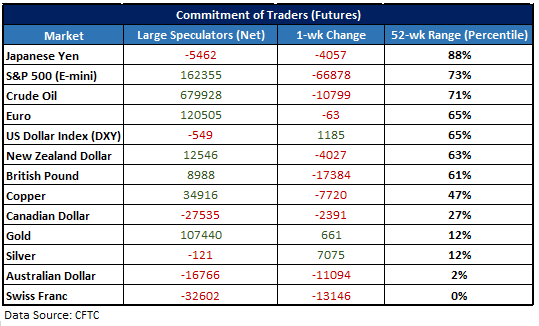

Every Friday, the CFTC releases a weekly overview of traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below are key statistics for net positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the strategies they typically employ. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing what their activity could mean about future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

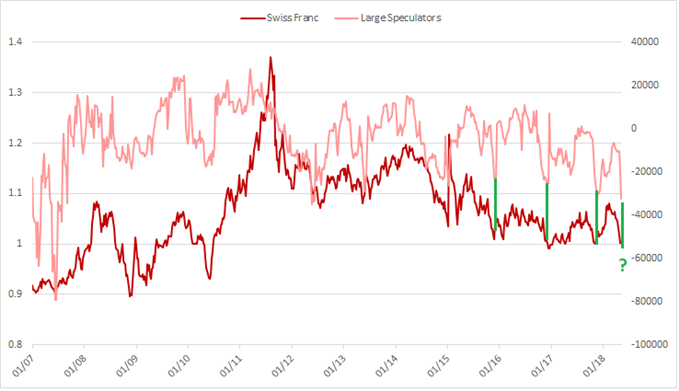

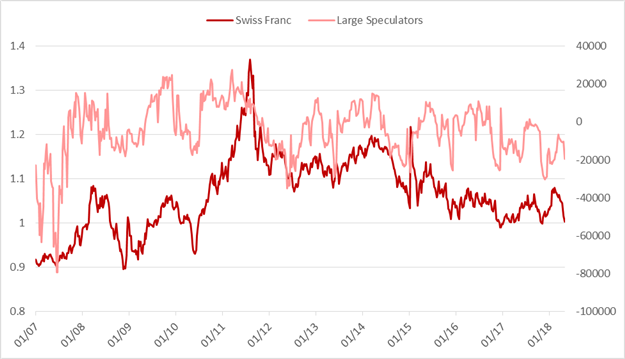

Swiss franc large speculators shortest since June 2012

The additional 13k contracts added to large speculators’ net short position in CHF was the largest since December 2016, pushing the total to -32.6k contracts, the most short since June 2012.

While the extreme itself is enough to give rise to the notion we are seeing oversold conditions, it is the velocity at which it occurred which is more convincing that the Swiss franc may be due for a bounce (USD/CHF down).

The last three times since late 2015 we have seen a similar downside move with such magnitude in positioning the franc was able to find a tradeable low versus the dollar.

Chart 1 – Swiss Franc Positioning (Seen this before lead to a low)

Looking at the chart, the sharp decline in the franc since February has recently pushed USD/CHF to its best levels in a year. Last week’s semi-bearish reversal candlestick on the weekly time-frame suggests momentum may have stalled on a failed attempt to hold above the October swing-high.

Between a failure to hold above resistance and the fierce move in positioning, there is reason to be bearish USD/CHF in the intermediate-term.

See how sentiment could tie into the Outlook for Major Currencies

Chart 2 – USD/CHF Weekly (Semi-bearish candle around resistance)

Large speculator profiles:

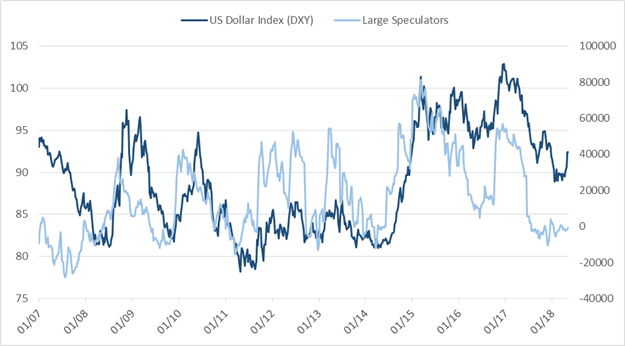

US Dollar Index (DXY)

Euro

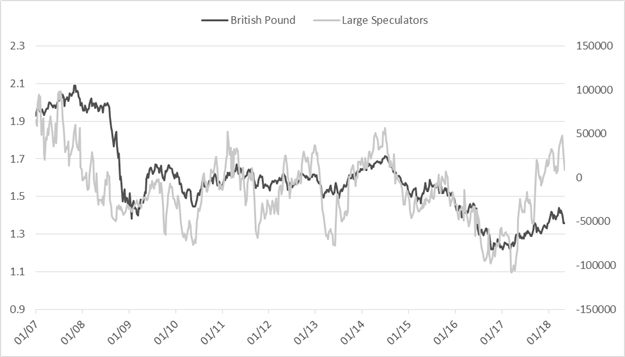

British Pound

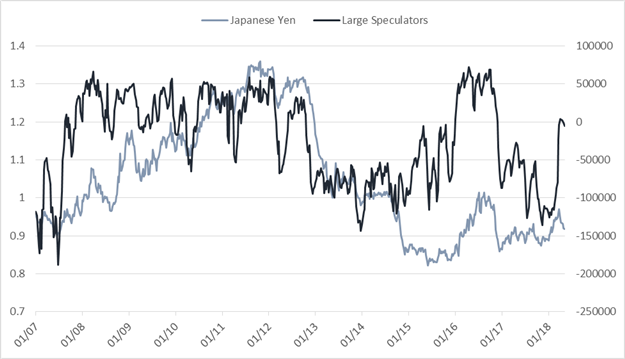

Japanese Yen

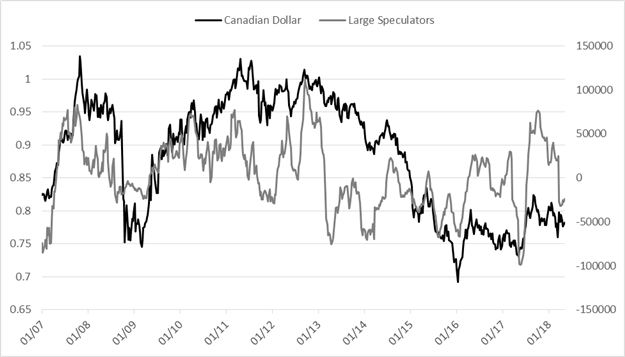

Canadian Dollar

Swiss Franc

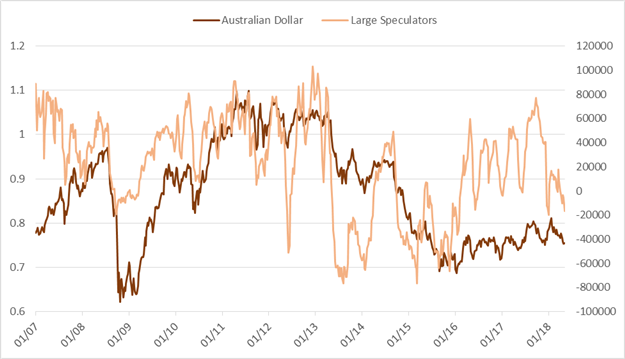

Australian Dollar

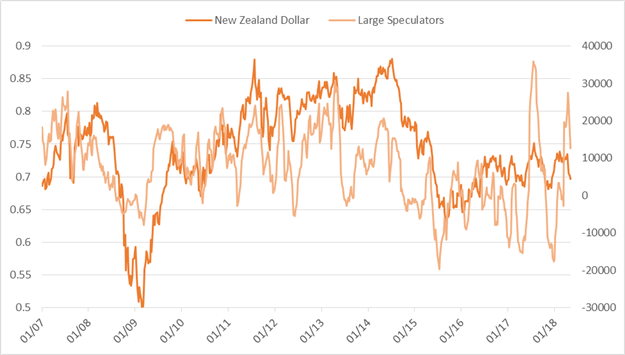

New Zealand Dollar

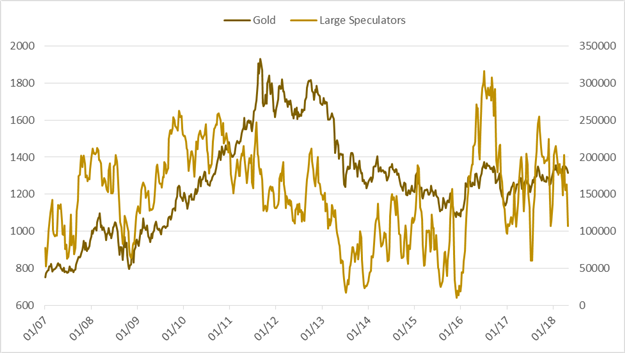

Gold

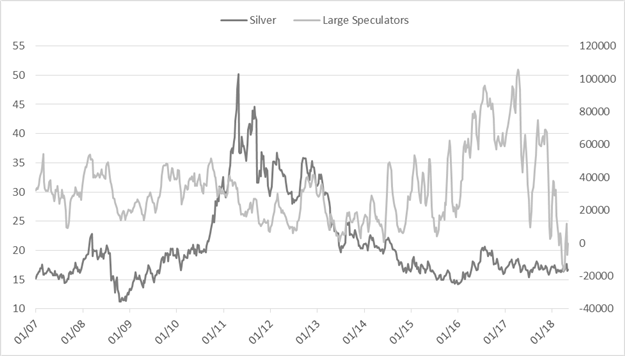

Silver

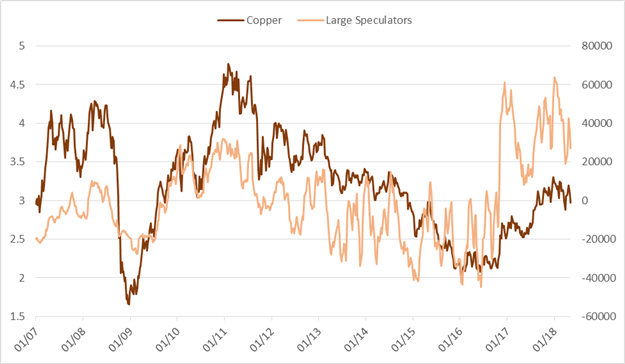

Copper

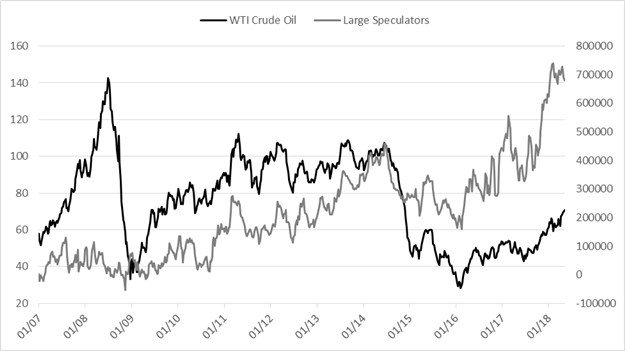

Crude Oil

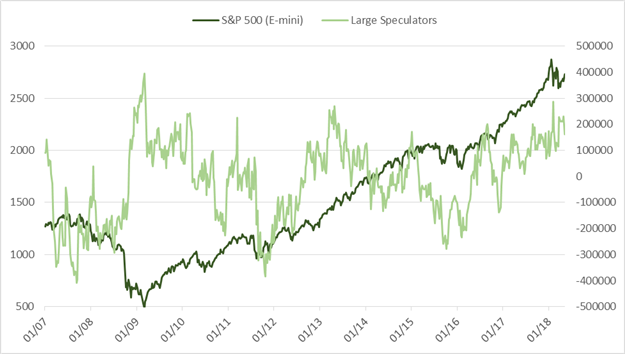

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX