CoT Highlights:

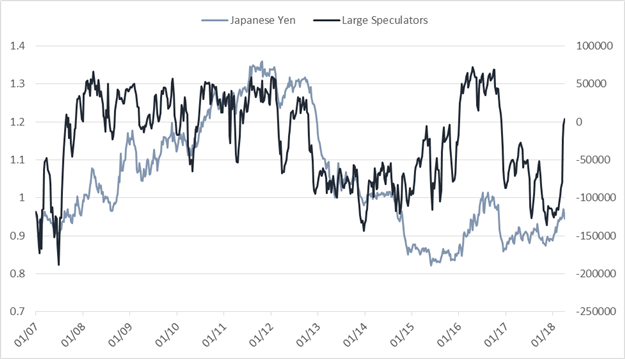

- Large speculators long Japanese yen first time since Nov 2016

- Aggressive covering past few months for a relatively small move

- Could it mark beginning of atrend? Two factors corroborate this notion

For shorter-term sentiment readings, see the IG Client Sentiment page.

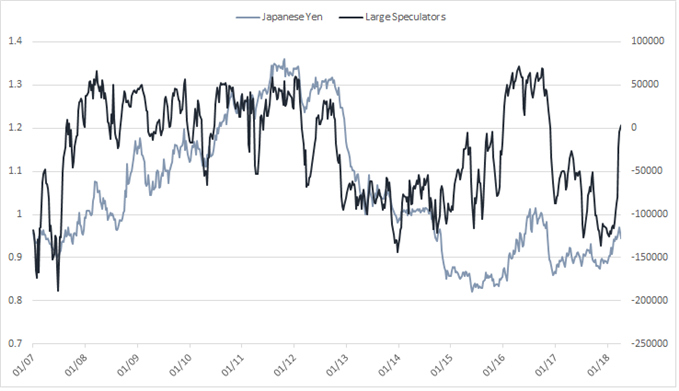

This past week’s report highlighted a noteworthy change in Japanese yen positioning, and while not a single-week extreme like we saw a couple of weeks back, it did mark the end of a trend of short positions held by large speculators. The group has been short the currency since late 2016, and with the relatively small move we have seen recently in price they have been spurred to cover and turn net-long. There are a couple of factors that suggest this was a 'logical' move.

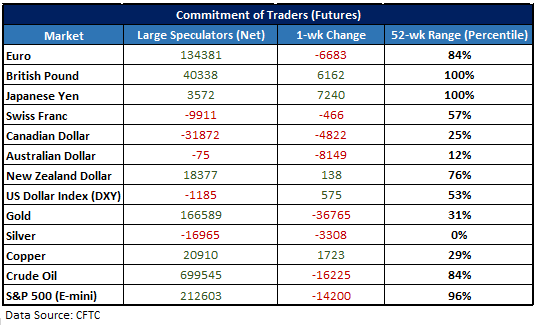

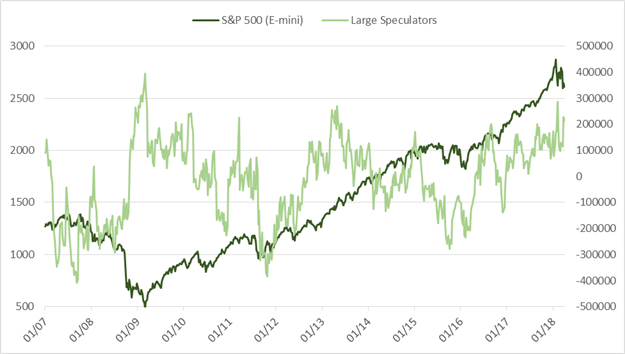

Each Friday, the CFTC releases their weekly report of traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below are key statistics for net positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the strategies they typically employ. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing what their activity could mean about future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

Large speculators long Japanese yen first time since Nov 2016

It isn’t a large long position at 3.6k contracts, and it wasn’t a large weekly change at +7.2k contracts, however; the changes compounded in recent months has taken large speculators’ historically large 125k+ short position in January and turned it to a long while JPY rallied only a relatively small amount versus USD.

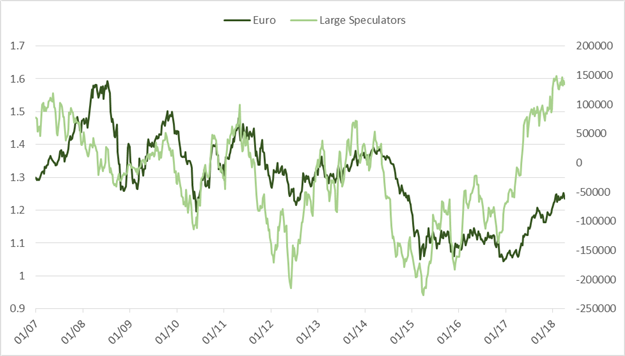

Large speculators in aggregate across all FX futures contracts have a relatively good long-term track record for identifying intermediate to long-term trends (especially in the euro). This recent flip may be yet another timely call, for a couple of reasons.

Stock markets are showing a significant amount of instability. In the past, the Japanese yen has typically seen buying during times of distress in the ‘risk-on’ trade, as was the case from January to last month. More selling in the stock market looks likely given where we are in the long-term cycle in the S&P 500.

Last year we saw a historically small range in USD/JPY. That range was snapped to start 2018 and appears more likely than not to continue, with not only aforementioned factor (sour risk sentiment), but also on the notion that breakouts after extended ranges tend to stay in motion for a period of time.

See how sentiment changes could tie into the DailyFX Q2 Forecasts.

Chart 1 – JPY Positioning

Chart 2 – USD/JPY Weekly

Large speculator profiles for major FX & markets:

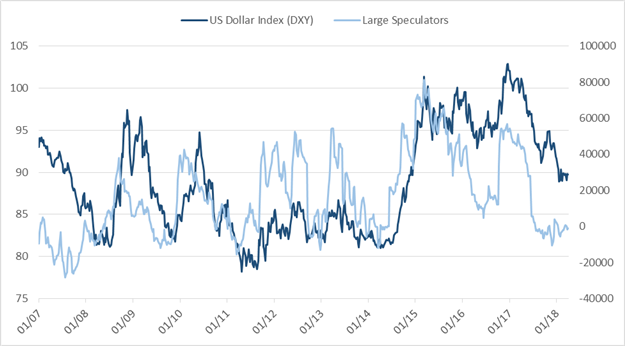

US Dollar Index (DXY)

Euro

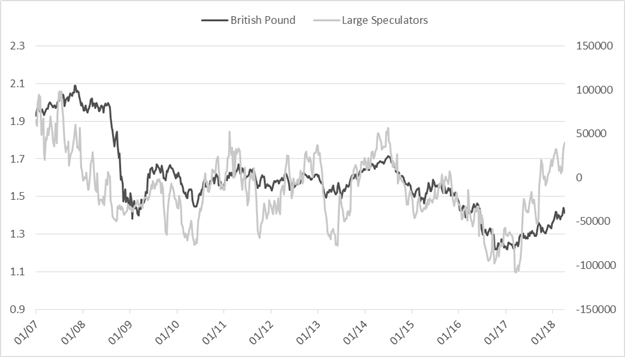

British Pound

Japanese Yen

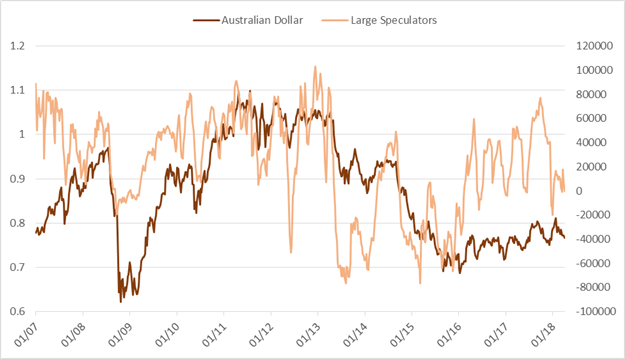

Australian Dollar

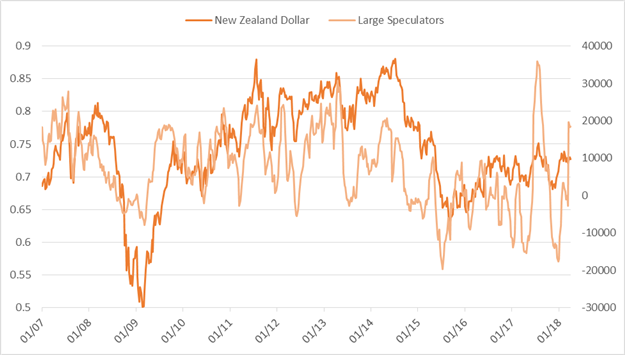

New Zealand Dollar

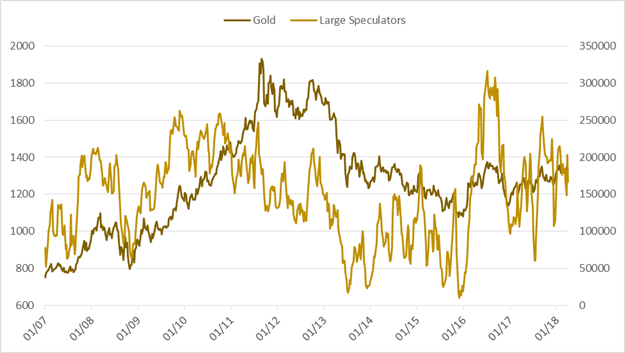

Gold

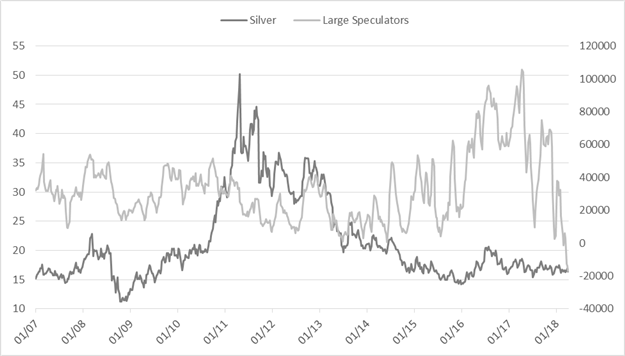

Silver

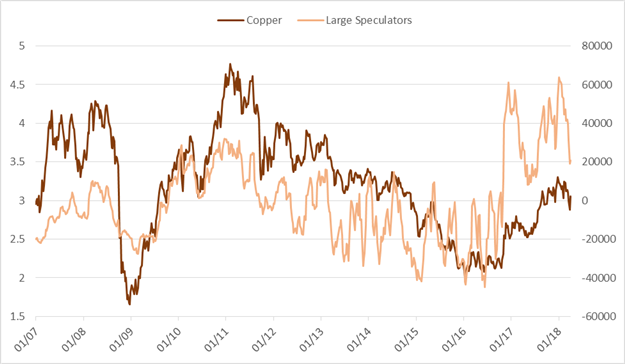

Copper

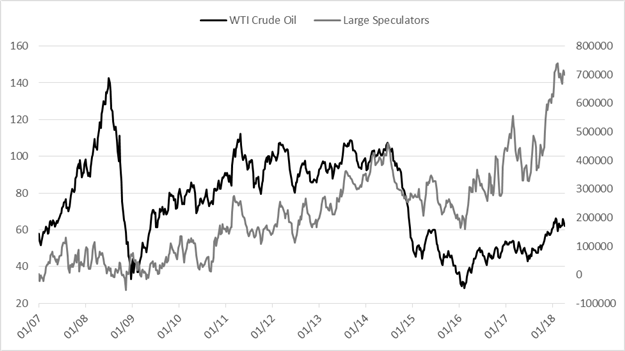

Crude Oil

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX