S&P 500, Bitcoin Price Analysis & News

- Tentative Turnaround for S&P 500

- Bitcoin Tests 21k

- EU Bond Market Fragmentation Talk

Equities: After the Black Monday type price action, equities are staging a modest turnaround Tuesday, however, markets are likely to be tentative with the Fed just around the corner. What’s more, markets are near fully priced in for a 75bps Fed rate hike this week, which had been sparked by WSJ reports late in the US session, in which the Fed Watcher stated that “a string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase”. In turn, several banks, including Goldman Sachs & JPM now see a 75bps rate hike this week. That being said, what was perhaps the most interesting market reaction had been equities, which initially rose on the back of the report. Perhaps a preview to how equities would react in such a scenario. Now while equities quickly retraced the initial upside, I do believe that a 75bps rate hike could prompt a bid in equities on the back of markets regaining trust in the Fed’s credibility in combating inflation.

S&P 500 Price Chart: 1-Minute Time Frame

Source: IG

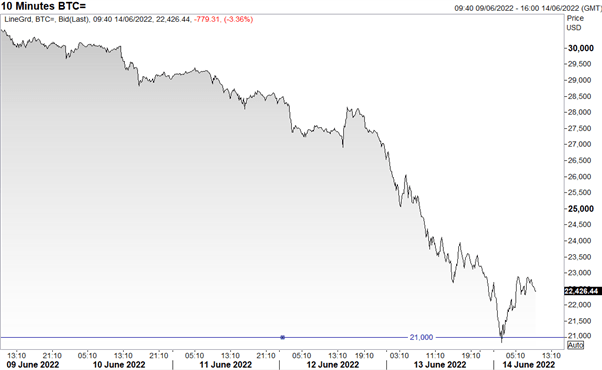

Bitcoin: Once again, cryptocurrencies prove it is a high-beta risky asset in light of the recent market turmoil. The cryptocurrency broke 21k overnight, which has significance for the most correlated crypto stock, Microstrategy, following comments made by the company’s CFO last month.

Microstrategy CFO "As far as where bitcoin needs to fall, we took out the loan at a 25% loan-to-value, the margin call occurs [at] 50% loan-to-value. So essentially, bitcoin needs to cut in half or around $21,000 before we'd have a margin call"

"Before it gets to 50%, we could contribute more bitcoin to the collateral package, so it never gets there, so we don't ever get into a situation of a margin call."

Bitcoin Chart: 10-Minute Time Frame

Source: Refinitiv

Bitcoin Chart: Weekly Time Frame

Source: Refinitiv

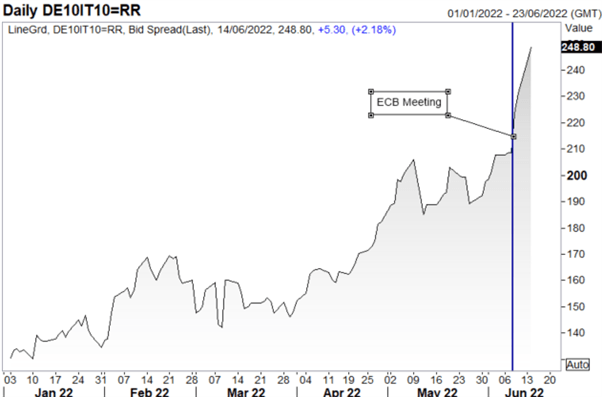

EU Bond Market Fragmentation

Since the ECB meeting, the Bund/BTP spread has widened by 30bps to near 250bps (highest since April 2020) following the lack of clarity by the ECB with regard to new tools to avoid bond fragmentation. In turn, with ECB’s Schanbel due to speak at 1820BST on bond market fragmentation, this will be key.

10Y Bund/BTP Spread: Daily Time Frame

Source: Refinitiv