USD/CAD, EUR/GBP Analysis and Talking Points

- USD/CAD Rallies into Key Resistance

- Canadian Data Unlikely to Impact Near-Term BoC Policy

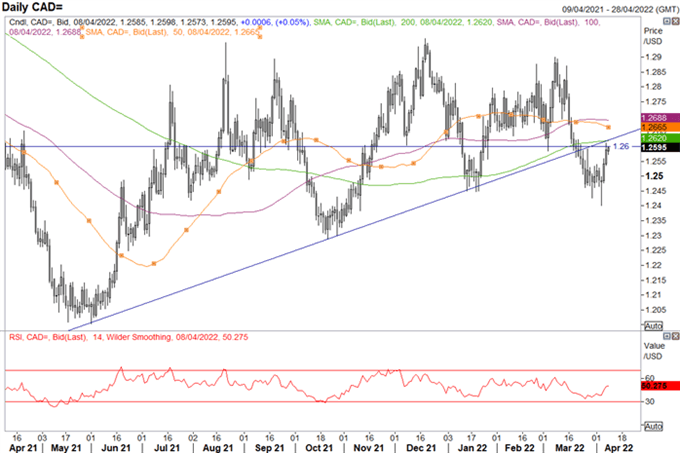

USD/CAD is back to its near term fair value, having failed to close below support at 1.2450. With interest rate differentials moving in favour of the US Dollar, combined with a modest pullback in risk assets, including oil, this has propelled the pair back to resistance at 1.2600. Heading into the May FOMC meeting, I remain bearish on risky assets, as such, while the terms of trade shock has largely shielded the CAD from the US Dollar’s dominance, souring risk appetite is likely to keep USD/CAD underpinned. Technically however, 1.2600-1.2700 has several hurdles in the form of the 50,100 and 200DMAs. Therefore, this will prove a tough zone to crack and likely cap upside to maintain a 1.2400-1.2700 range.

A Helpful Guide to Support and Resistance Trading

USD/CAD Chart: Daily Time Frame

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

Canadian Data Unlikely to Impact Near-Term BoC Policy

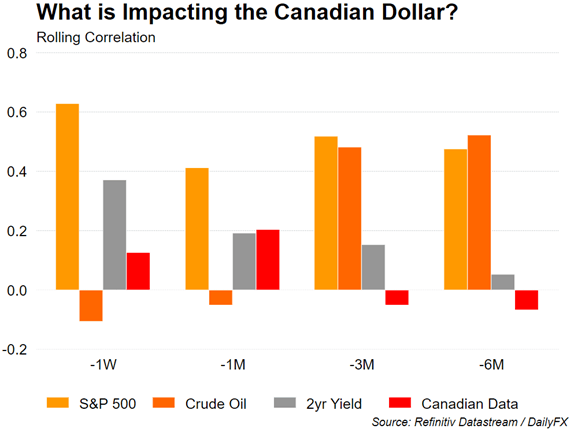

Today’s Canadian jobs report is unlikely to move the needle for near-term BoC policy with a 50bps rate hike baked in for next week’s monetary policy meeting. Canadian employment is above pre-pandemic levels and wages look set to continue its upward trajectory. As shown in the image below, Canadian data has had little influence on the Loonie.