DAX, German Bund Yield Analysis:

- Civilian casualties reported in Ukraine as armored tanks head towards the capital

- German Bund yields plummet as investors flee from risky assets, ECB rate hike probability drops

- DAX gains limited – key technical levels analyzed

European Stocks Continue to Struggle amid Uncertainty

European stocks have struggled in comparison with US equities, which have risen a fair distance from recent lows. However, the FTSE and particularly the DAX, struggle to lift off recent lows and remain vulnerable to a retest of the recent low. News and satellite imagery of multiple tanks and fuel tankers said to be enroute to Kiev highlights another day of military conflict.

Ukrainian sources reported that 70 soldiers died in a rocket attack in a location between Kiev and Kharkiv. Yesterday’s talks between Ukrainian and Russian delegates on the Belarussian border failed to quell the violence however, talks are said to continue but no specific date has been confirmed.

German Bund Yield Slumps as Risk-off Sentiment Grips Markets

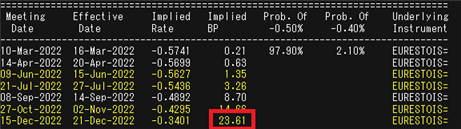

The 10 year German Bund yield which began the day around 0.14% has hurtled into negative territory in a massive decline which is largely reflective of the geopolitical uncertainty and a sizeable reduction in ECB rate hike expectations for 2022.

German Bund Yield Daily Chart

Source: IG, prepared by Richard Snow

Before Russia invaded Ukraine, Eurozone money markets expected around 40 basis points of hiking which was revised lower, around 30 bps on Monday, while on Tuesday we’re seeing around 23bps. Markets will continue to recalibrate the likelihood of rate hikes in a lower growth environment throughout Europe with the added pressure of soaring inflation.

Implied BoE Rate Hikes via Rates Markets

Source: Refinitiv, prepared by Richard Snow

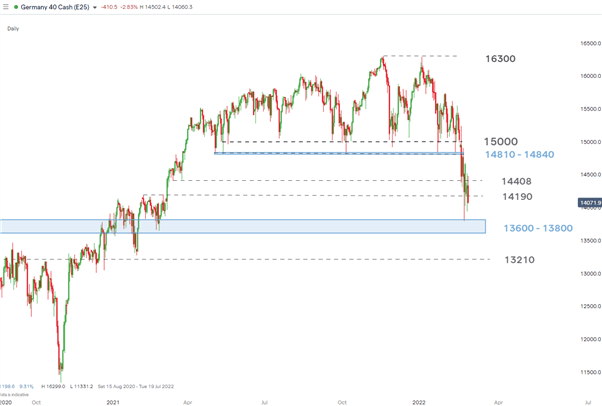

DAX 40 Index Down 10% Year to Date

The DAX daily chart shows how volatile German equities have been over the last few days as events unfold over Ukraine. Germany is fairly reliant on Russia for gas which currently makes up around 20% of Germany’s energy mix and also includes coal, renewables and nuclear.

Price action sits around 14,190 with support coinciding with the recent low at 13,800. Near-term resistance comes in at 14,408 before 14,810 can be considered.

DAX Daily Chart

Source: IG, prepared by Richard Snow

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX