EUR/USD Price, Chart, and Analysis

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

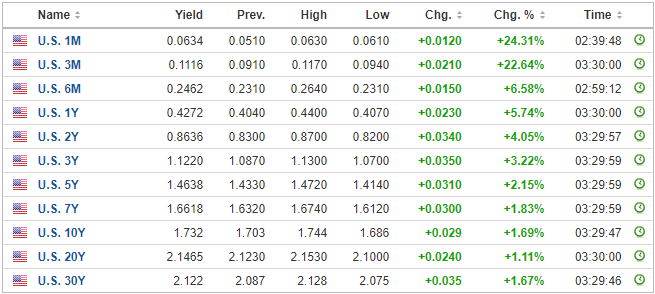

The latest FOMC minutes suggested that the US central bank may need to hike interest rates earlier than previously expected and begin selling off its Treasury holdings ‘soon after beginning to raise the federal funds rate’, in order to control runaway US inflation. US Treasury yields popped higher after the release and continued to move higher through the Asian session and into Europe. The interest rate-sensitive two-year is now quoted with a yield of 0.865%, a fresh 23 month high, while the benchmark 10-year UST is quoted at 1.732% and nearing levels last seen two years ago.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

The US dollar moved slightly higher post-release but with rate hikes in the US already fairly well priced into the market, the move was fairly muted. However, the talk of unwinding the Fed’s balance sheet earlier than previously expected will underpin the US dollar going forward with higher USD rates giving the greenback an advantage over lower-yielding currencies, including the Euro.

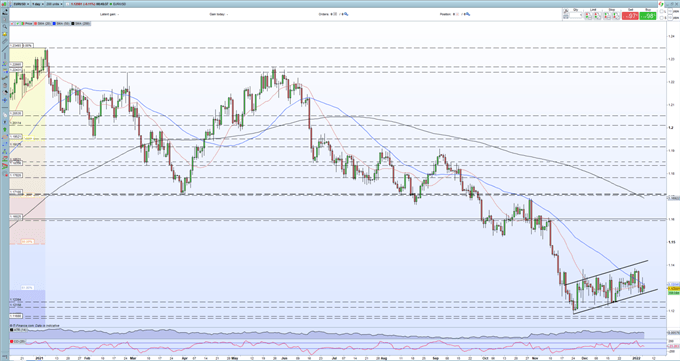

The daily EUR/USD chart shows the sustained sell-off in the pair since mid-May with a series of lower highs and lower lows noticeable and intact. There is also a basic bearish flag formation on view, suggesting lower prices ahead. There are a few prior low prints all the way back down to the late-November low at 1.1185 which look likely to be tested as the pair fade lower.

EUR/USD Daily Price Chart January 6, 2022

Retail trader data show 58.74% of traders are net-long with the ratio of traders long to short at 1.42 to 1. The number of traders net-long is 9.37% lower than yesterday and 1.38% higher from last week, while the number of traders net-short is 11.86% higher than yesterday and 3.35% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.