Swiss Franc, CHF, CHF/JPY, AUD/CHF, EUR/CHF – Talking Points

- CHF/JPY consolidating around June swing high after deep sell off

- AUD/CHF falls back into descending channel after sharp decline on 11/26

- EUR/CHF testing key 1.04 level, room to run below if level breaks

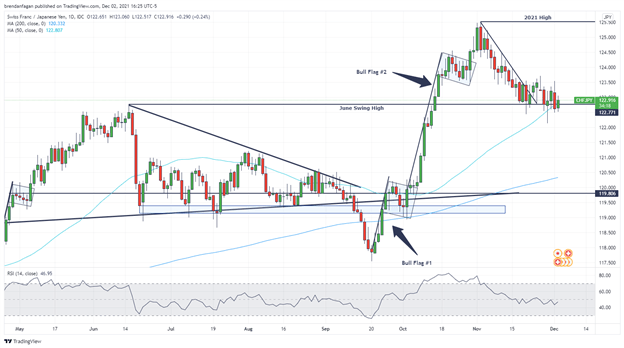

CHF/JPY Technical Analysis

After roaring to fresh yearly highs in early November, CHF/JPY came crashing back down to Earth, ultimately settling around the 123.00 area. Price of late has traded sideways, with the cross looking for direction. CHF/JPY’s sideways price action comes as a result of recent relative strength in both currencies. Price appears finely coiled around the June swing high of 122.77, with the 50-day moving average also present at 122.80. The June swing high may continue to represent a solid pivot point, with bias skewed to the upside as long as the level holds. A sustained break below the current area could invite a test of the 122.00 psychological level.

CHF/JPY Daily Chart

Chart created with TradingView

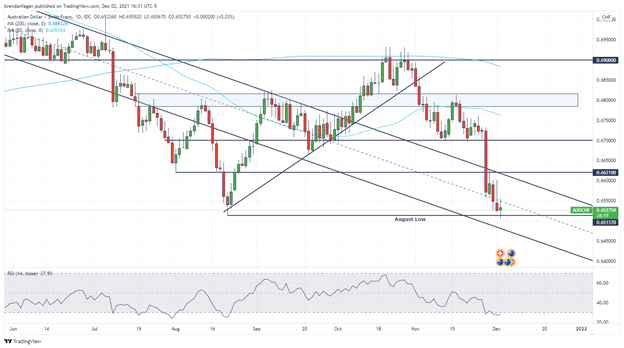

AUD/CHF Technical Analysis

A sharp drop in the 11/26 session saw AUD/CHF break below 0.6700, a level that had been propping up price throughout November. This break to the downside has brought AUD/CHF back into a descending channel that supported prices earlier in the year. The sharp decline in the cross has seen the pair dip below 30 on the relative strength index (RSI), indicating that oversold conditions are currently present. Mean reversion traders may look for entry in the near-term, looking for the pair to retrace some of its sudden losses. Just below current prices, AUD/CHF may find support in the August low at 0.6513. Below the August low, price may find additional support in the lower bound of the descending channel.

AUD/CHF Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

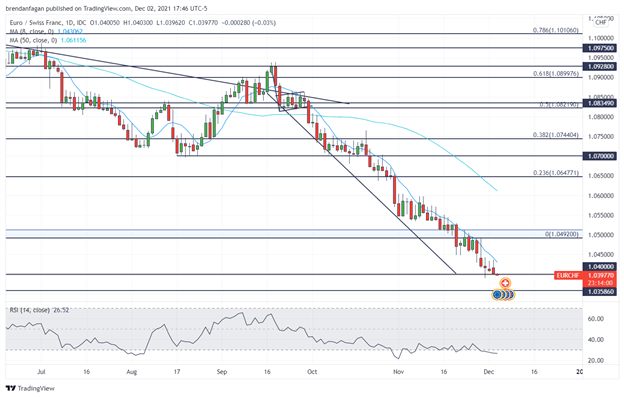

EUR/CHF Technical Analysis

If there was a pair that could be used to define a “clear trend,” EUR/CHF would be it. Price has steadily declined after finding resistance around 1.09820 in mid-September. Since breaking below the 50-day moving average in late September, the pair has failed to look back. This sustained move lower has ushered in 6-year lows, with price last trading below current levels in 2015. Should the psychological 1.04000 level fail to hold, price may look to test the monthly low from July 2015 at 1.03586. Should the cross stage a miraculous reversal, the 8-day moving average could serve as an ideal first target around 1.04305.

EUR/CHF Daily Chart

Chart created with TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter