Gold Price (XAU/USD), Chart, and Analysis

- Gold below $1,800/oz. while US 10-year bond yield falls further.

- Existing vaccines may struggle to contain Omicron says Moderna CEO.

- Traders increase net-longs, reduce net-shorts.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Moderna CEO Stephane Bancel rattled the markets late in the Asia session by warning that the current crop of Covid-19 vaccines may be less effective at controlling the Omicron variant and that a new vaccine may take many months to modify before it can be released. This warning turned markets risk-off again and wiped out most, or all of Tuesday’s relief rally with oil and equities taking the biggest hit.

Against this backdrop, gold should shine due to the long-held view that the precious metal is a risk-off asset. Yet the precious metals’ performance over the last few days has been lackluster at best. In contrast, the 10-year US Treasury, a benchmark risk-off asset, has rallied sharply sending its yield tumbling by 10 basis points to just above 1.42%. The yield on the UST 10-year was quoted at 1.675% one week ago.

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

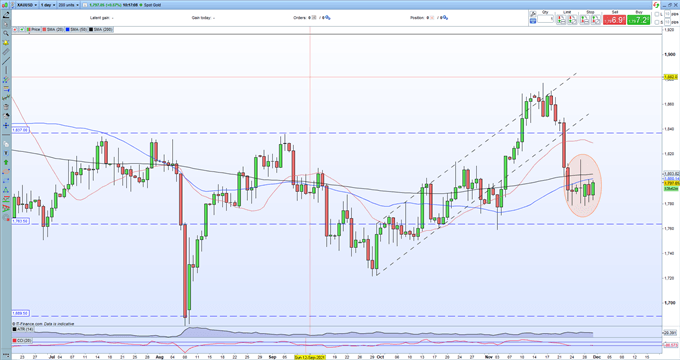

With gold’s risk-off status under question, at least in the short-term, the price of the precious metal may struggle to move higher, despite looking oversold. A cluster of prior lows just above $1,778 should act as initial support before the 50% Fibonacci retracement level at $1,763.5/oz. comes back into play again. Below here is $1,722/oz.

Gold (XAU/USD) Daily Price November 30, 2021

Retail trader data show83.26% of traders are net-long with the ratio of traders long to short at 4.97 to 1. The number of traders net-long is 5.10% higher than yesterday and 7.61% higher from last week, while the number of traders net-short is 8.66% lower than yesterday and 22.32% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.