USD, GBP, EUR/GBP Analysis and News

- NFP Less Impactful In Light of Fed Action

- GBP Edging Towards YTD Lows

- EUR/GBP A Better Avenue to Fade GBP Weakness

USD: Now that the long-awaited Fed taper decision is here, the focus will turn to the rate outlook for 2022. However, while NFP tends to garner traders attention each month given the implications for Fed policy, in light of the Fed’s decision out of the way, I would expect a more muted affair for today’s NFP. Unless of course, the jobs report deviates notably from consensus.

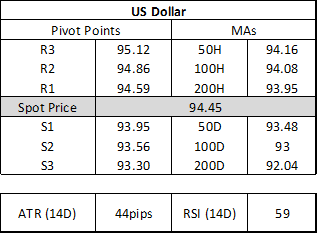

US Dollar Technicals

GBP: Unsurprisingly, the Pound is the worst performer after yesterday’s BoE decision. In which the shock scenario had been realised. A reminder as to the scenario we highlighted in the BoE preview.

“The shock scenario would be for the Bank of England to not raise rates on the basis that markets are fully priced in for a rate lift-off at this week’s meeting. Therefore, should this scenario be realised, this would leave GBP at risk of dropping to 1.3500 and prompt gilts to rally aggressively”… link

With the Pound extending its pullback since the European open, eyes are on the year to date low, situated at 1.3410. Below which, opens the door towards 1.3200-1.3300.

GBP/USD Chart: Daily Time Frame

Source: Refinitiv

EUR/GBP: That being said, for those looking to fade GBP weakness, a more appropriate avenue would be via EUR/GBP, given that while the BoE decision was a surprise, they remain relatively more hawkish than the ECB. On the technical side, the 200DMA is being tested, however, should the cross close above, a look for exhaustion is likely around the mid 0.86s.

EUR/GBP Chart: Daily Time Frame

Source: Refinitiv