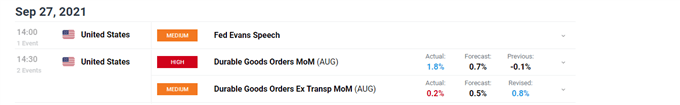

US Durable Goods Orders Smash Forecasts (1.8% vs 0.7%)

US durable goods orders came in at 1.8% after forecasts only expected a 0.7% increase. Most of the increase was seen in the transportation sector which accounted for the large majority of the 1.8% total increase.

For all market-moving data releases and events see the DailyFX Economic Calendar

The reading comes off the back of the Markit Manufacturing PMI data last week that failed to meet expectations but still looks positive at 60.5. Readings over 50 indicate an expansion of the manufacturing sector.

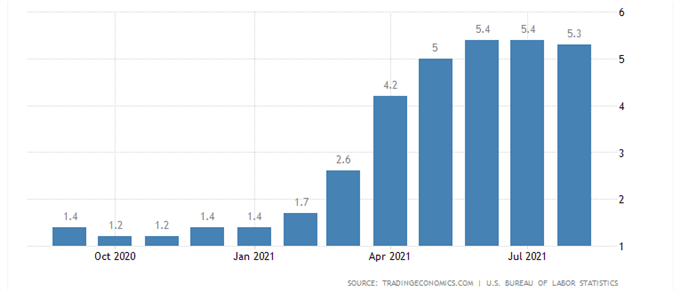

Durable Goods Orders: A Reflection of Moderating Inflation?

The US durable goods data remains well above zero but is well below the 3.5% figure observed in May – a time when inflation data rose higher and higher. Since then, we have seen a modestly lower inflation reading as the Fed remains supportive that price pressures are ‘transitory’ in nature – unlikely to persist for long periods of time.

US Inflation Figures

Year on year CPI data was down slightly for August (5.3%) compared to the June and July reading of 5.4%. In general, consumers of durable goods are more likely to make purchases today if they anticipate raising levels of inflation because it makes more sense to buy at current prices than at higher prices down the line. Therefore, the surprise in the data may be suggestive that consumers feel that inflation may remain elevated for a while longer.

US Dollar Basket Reaction to the Durable Goods Orders Print

Chart prepared by Richard Snow, TradingView

The US Dollar index (DXY) has been trading higher in the lead up to the data but the immediate reaction witnessed a slight pullback from the daily trend. DXY remains up for the day thus far.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX