GOLD PRICE OUTLOOK:

- Gold prices held gains after rallying 2.9% over the last 3 trading sessions

- Disappointing Chinese retail sales and industrial production figures dented risk sentiment

- Prices are eyeing $1,785 for immediate resistance, breaching which may open the door for further gains

Gold held steadily during Tuesday’s APAC session after gaining 2.9% over the last three trading days. Risk sentiment turned sour after China reported disappointing retail sales and industrial production figures for July, underscoring downward pressure amid viral resurgence and severe weather conditions.

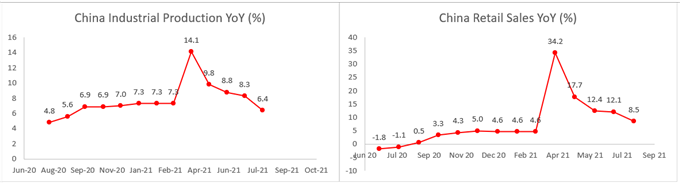

The growth rate of industrial production moderated to 6.4% YoY in July, marking a 4th consecutive monthly decline (chart below). This also missed market expectations for a 7.8% growth. Retail sales growth declined to 8.5% from 12.1% a month ago, falling sharply below a baseline forecast of 11.5%. This suggests that measures to curb the Delta variant and a flood in Henan province have had greater-than-expected impacts on consumer spending and production. As a result, APAC equities turned sharply lower and haven-linked assets climbed. Precious metals held Friday’s gains against this backdrop.

China Industrial Production and Retail Sales – Past 12 Months

Source: Bloomberg, DailyFX

Looking ahead, traders are eyeing Wednesday’s FOMC meeting minutes for details about the Fed’s policy outlook. Besides, US retail sales figures and the RBNZ interest rate decision are also in focus.

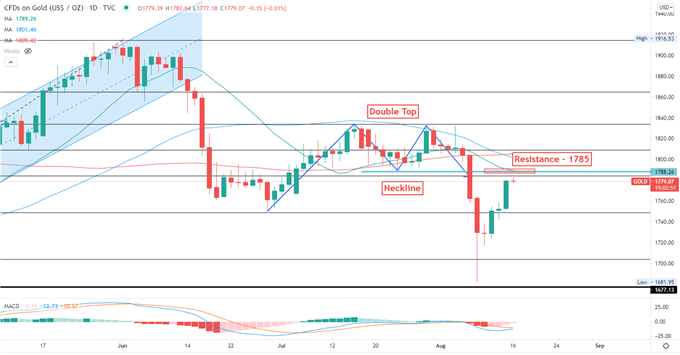

Technically, gold prices rebounded from a 4-month low as the DXY US Dollar index retreated. Prices are about to challenge an immediate resistance level at 1,785 – the 61.8% Fibonacci retracement. A failed attempt to breach 1,785 may lead to a pullback towards 1750 for immediate support. The MACD indicator is about to form a bullish crossover, suggesting that upward momentum may be building.

Gold - Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter