Key Talking Points:

- Unwinding of oversupply and improving demand forecasts underpin crude oil price performance

- WTI Crude bullish momentum to continue if price can consolidate above $65

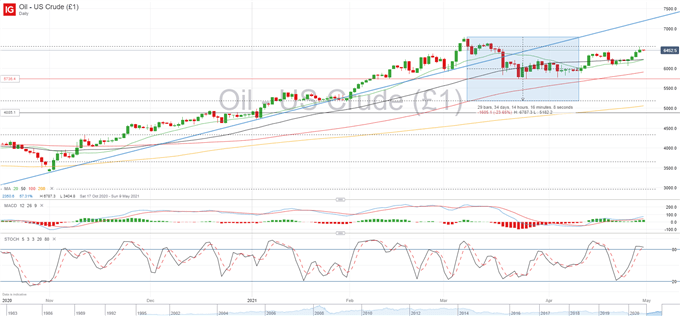

After a choppy start to the month, crude oil has been picking up pace in recent sessions and is now just below $65 per barrel. There has been quite a bit of noise in the last few months as the virus situation worsened in many countries just after the new year, but WTI crude has been able to keep momentum above $57.30 per barrel for most of it. This area is likely to offer strong support going forward as the bias turns bullish in the short term. For now, as long as price stays above the $60 mark, buyers are likely to remain in control as further upside momentum is achievable under current conditions.

WTI Crude Daily chart

That said, there is a risk that the recent burst of new Covid-19 cases in India could end up spilling into other countries. With cases of the Indian variant already reported in France and China, those countries which have lagged in their vaccination programes could be at risk of a surge in cases as the new variant seems to be highly contagious. As has been over the last few months, any risk to economic recovery will be detrimental to oil prices as demand for the commodity is underpinned by the reopening of economic activity.

But for now, positive economic data and a weaker dollar are outweighing the concerns over the Indian variant, which is helping the price of WTI crude push towards its post-pandemic high of $67.87 seen on March 7th. The expected rise in demand in the next few months is also offsetting the concerns over Covid-19, with OPEC suggesting that they believe demand will pick up by about 6 million barrels a day in the back half of this year. Demand for gasoline is likely to be a big driver in the next few months as people resume the travel plans they have been unable to enjoy in the last year.

The removal of excess supply is also likely to put upward pressure on oil prices, so I expect the market to drift higher in the next few months, with the possibility of small corrections offering a buy-the-dip market in the short term. Once the $65 mark is cleared, buyers are likely to face resistance until they reach the March high at $67.87, at which point the $70 mark comes into play. Ideally, I would like price to get back above the prior ascending trendline to consolidate bullish momentum even higher, but it may be a case of flattening out the trendline in the coming months.

How to Read a Candlestick Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin