GOLD PRICE OUTLOOK:

- Gold prices rebounded mildly during the APAC trading hours as the US Dollar fell

- Demand for safety remains elevated as Japan faces new state of emergency measures

- Gold prices have likely formed a bearish “AB=CD” pattern, pointing to a technical correction

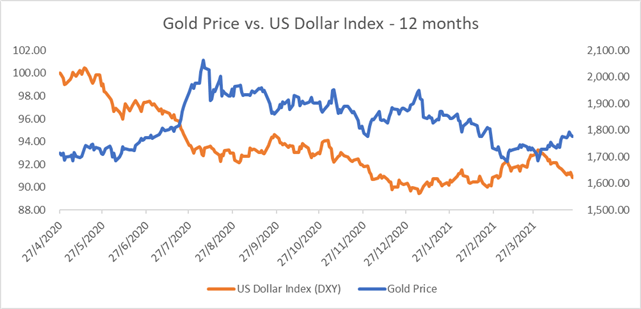

Gold prices rebounded modestly during early in the APAC trading session. A weakening US Dollar appeared to be supporting the precious metal. Indeed, the two historically demonstrate a strong negative correlation (chart below). The DXY US Dollar index fell to an eight-week low of 90.75 ahead of this Thursday’s FOMC meeting, as investors anticipated a dovish Fed to support economic recovery.

The rebound in gold prices was mild however, as the 10-year Treasury yield edged slightly higher to 1.563%. Stronger-than-expected new home sales and manufacturing PMI data from the US boosted inflation hopes alongside robust corporate earnings. Higher longer-dated rates served to suppress gold prices as the opportunity cost of holding the yellow metal increased.

Gold Prices vs. DXY US Dollar Index

Source: Bloomberg, DailyFX

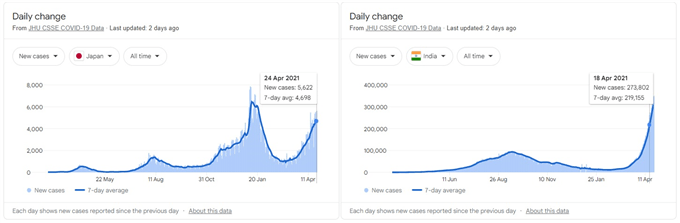

Across the Pacific, deteriorating viral situations in Japan and India appeared to have dampened the growth outlook, boosting the demand for safety. Japanese government declared a third round of state-of-emergency measures in Tokyo, Osaka and two other prefectures in an attempt to halt a surge in coronavirus cases. The measures started on Sunday and will last until at least 11 May, casting a shadow over the upcoming Tokyo Olympics.

India reported another record daily increase in coronavirus infections, with 349,691 cases added over the past 24 hours. The Prime Minister Narendra Modi urged all citizens to be vaccinated and exercise caution, saying the “storm” of infections had shaken the country. Asia Pacific investors are deeply concerned about the viral situation in India, which may dampen the recovery and reopening prospects in the region. Against this backdrop, gold prices could be buoyed by rising demand for safety as a new wave of uncertainties emerges.

Daily Increase in Covid-19 Cases – Japan and India

Source: Google

Looking ahead, the FOMC and BoJ interest rate decisions and a slew of GDP data from the US and Europe may be closely eyed by gold traders this week. Although the conditions for the Fed to consider interest rate hikes are still far from met, improving fundamental metrics may point to a faster pace of tightening in its asset-purchasing program. A more hawkish-biased Fed may derail gold’s upward trajectory. The opposite is true if the central bank remains dovish in its monetary outlook.

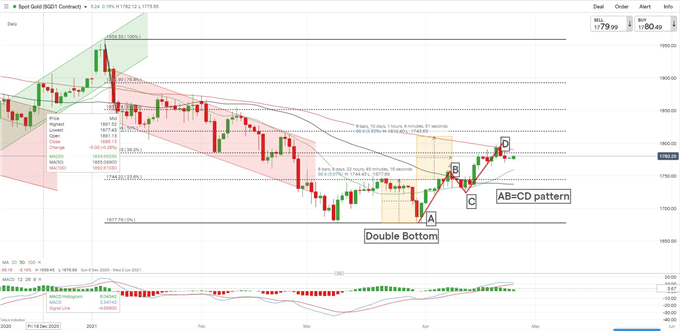

Technically, gold has likely formed a bearish “AB=CD” pattern as highlighted in the chart below. An “AB=CD” pattern is characterized by parallel “AB” and “CD” legs of similar timeframe and magnitude. A pullback from the “D” point is likely following the completion of the pattern.

On the gold chart, the “AB=CD” pattern is part of a larger “Double Bottom” pattern. A “Double Bottom” chart pattern is perceived as a strong bullish indicator. An extension beyond the “D” point higher would likely invalidate the “AB=CD” pattern and open the door for further upside potential with an eye on $ 1,808 – the 50% Fibonacci retracement.

Gold Price – Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter