Singapore Dollar, USD/SGD, Monetary Authority of Singapore, MAS, GDP – Market Alert

- Singapore Dollar gains on static MAS and solid local Q1 GDP data

- USD/SGD likely catching up with recent weakness in the US Dollar

- Eyes on key inflection point for chance to retest current 2021 lows

The Singapore Dollar advanced against the US Dollar following the Monetary Authority of Singapore (MAS) policy announcement and local first-quarter GDP data. The MAS largely left policy settings unchanged, as expected. Taking a look at the central bank’s approach to its currency, it left the slope (at 0% appreciation), width and center of the currency band unchanged.

The MAS primarily conducts policy by managing exchange rates rather than benchmark lending rates. It does this by adjusting SGD against an undisclosed basket of currencies, known as the Singapore Dollar Nominal Effective Exchange Rate. This is due to the city-state’s heavy reliance on trade, where a shifting currency can have more meaningful impact on local inflationary pressures, while also allowing for free capital flows.

Highlights from the MAS

- An accommodative policy stance remains appropriate

- Singapore’s economy will grow at an above-trend pace this year

- Core inflation should rise gradually, but remain below its historical average

- 2021 GDP growth may top the upper end of the 4% - 6% estimated range

- Sees 2021 all-items CPI at 0.5% - 1.5%

Meanwhile, advanced readings showed that Singapore’s economy expanded 2.0% q/q versus 1.7% expected, and 0.2% y/y compared to -0.5% estimated. Commentary from the MAS and the GDP data continued to underpin Singapore’s recovery from the outbreak of coronavirus last year. Moreover, since the economy is heavily reliant on the external sector, the MAS inherently paints a rosy outlook for global growth.

The Singapore Dollar’s strength despite a static MAS may have been due to the passing of prominent event risk. USD/SGD was relatively flat over the past 24 hours despite a drop in Treasury yields and the US Dollar. Now that the MAS and GDP data are behind markets, the Singapore Dollar likely caught up with broader developments.

Despite faster-than-expected headline and core CPI data from the United States on Tuesday, dovish commentary from the Federal Reserve likely cooled fears about sooner-than-anticipated tightening. This may in the near-term keep Treasury rates from rising too swiftly, benefiting Emerging Markets and keeping capital outflows from picking up pace. As such, there seems to be scope for near-term declines in USD/SGD ahead.

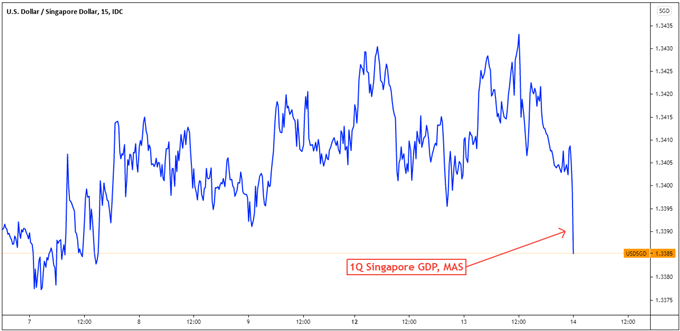

USD/SGD 15-Minute Chart

Chart Created Using TradingView

Singapore Dollar Technical Analysis

USD/SGD is again pressuring the key 1.3375 – 1.3389 inflection zone, with the 50-day Simple Moving Average (SMA) sitting right below. A breach under these levels could open the door to extending losses, especially as the long-term 200-day SMA comes into play above. That would likely place the focus on the 1.3158 – 1.3189 support zone for another shot at resuming last year’s top.

USD/SGD Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter