Euro Price, News and Analysis:

- EUR/USD popping higher as the US dollar turns lower again

- EUR/GBP being forced lower by a strong Sterling.

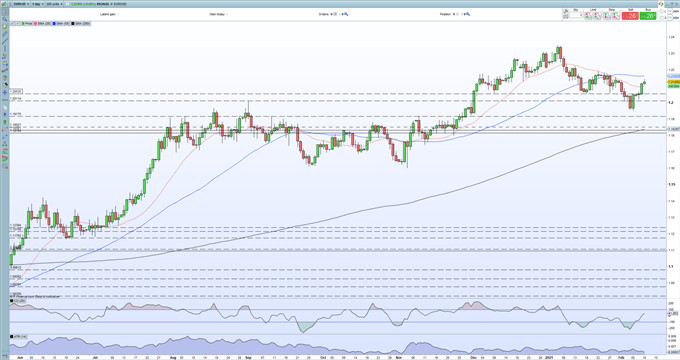

EUR/USD has arrested its recent decline and turned higher, with the move driven by the current weakness in the US dollar. The pair traded as low as 1.1950 recently but EUR/USD is now back above 1.2100 and eyeing further gains. Coming up today, US inflation data (January) at 13:30 GMT, while later in the session, Fed Chair Jerome Powell’s speech will be closely followed for any update on the health of the US economy. This data release and Powell’s speech may well be the next short-term driver of the greenback. Initial resistance off the 50-day simple moving average at 1.21625 before a cluster off recent highs all the way back to 1.2192.

For all market-moving economic data and events, see the DailyFX Calendar.

EUR/USD Daily Price Chart (June 2020 – February 10, 2021)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

IG Retail trader data show 42.31% of traders are net-long with the ratio of traders short to long at 1.36 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

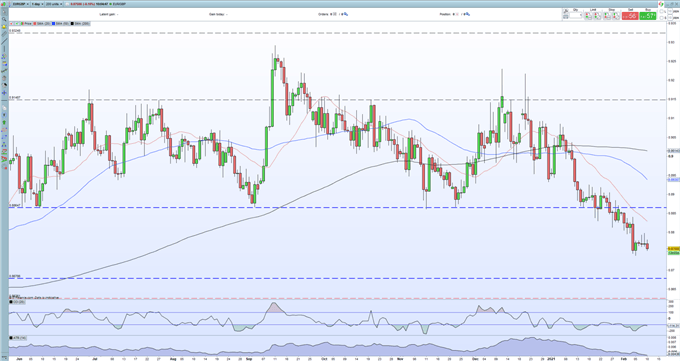

EUR/GBP is moving the other way and continues to slide lower on the back of renewed Sterling strength. The British Pound continues to pick-up a bid from the strong UK covid-19 vaccination program that now looks increasingly likely to beat the government’s target of 15 million vaccinations by February 15. In addition, the number of new cases and fatalities is falling sharply across the country, prompting more discussions about re-opening the economy.

The recent nine-month low at 0.87386 is tantalisingly close and looks likely to fall in the short-term. Below here there is an old swing low at 0.86710made at the end of April last year before the chart opens up to sub-0.8600 price action. The pair look mildly oversold, using the CCI indicator, but this is unlikely to stem any move lower.

EUR/GBP Daily Price Chart (June 2020 – February 10, 2021)

What is your view on EUR/USD and EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.