Bitcoin (BTC/USD) Price Outlook:

- Bitcoin has been on the backfoot since January 8 when it tagged its all-time high

- Despite recent losses, BTC/USD has found sturdy support from $28,000 to $30,000

- Bitcoin vs Gold: Top Differences Traders Should Know

Bitcoin Price Forecast: Will Retail Traders Pile into Bitcoin Next?

The longtime speculative favorite of capital markets, Bitcoin, has taken a backseat to single stock names over the last few sessions as companies like GameStop, AMC, BlackBerry and American Airlines soar - until recently - on the back of targeted retail interest. Outside of the limelight, Bitcoin has continued its retreat from the record levels it established earlier this month.

As some of the favorite names targeted by retail traders face trading restrictions, the crowd may return to Bitcoin as a speculative alternative. While renewed interest in BTC/USD could boost price somewhat, retail traders have a limited role in the cryptocurrency and, as such, a break above the recent downtrend will be required before a serious continuation might unfold. Further still, there is little to suggest Bitcoin will be the vehicle chosen as other markets, like silver, enjoy a bid from potential retail speculation.

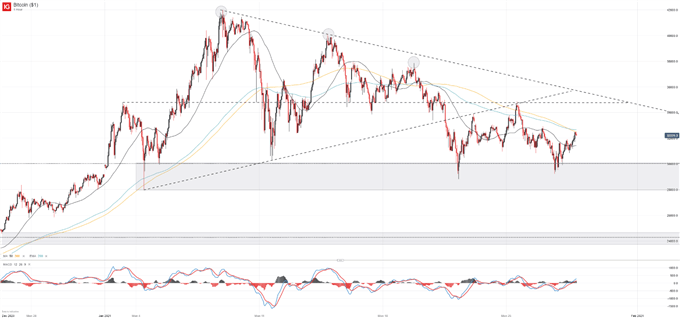

Bitcoin (BTC/USD) Price Chart: Hourly Time Frame (December 2020 – January 2021)

To that end, Bitcoin traders should still look to the technical landscape for insight. Apparent support from the $30,000 to $28,000 area has helped buoy price since early January and should be viewed as an important landmark for bulls. Should price break beneath the zone, BTC could accelerate downward as support is relatively sparse until the Fibonacci level around $24,230.

On the other hand, a plethora of resistance resides overhead following the digital currency’s recent retracement. Initial resistance might be found near the $34,800 mark which coincides with the January 3 swing-high and the January 25 peak. A potential confluence of resistance lies slightly northward, just shy of $36,000 where an ascending trendline from early January and a descending trendline from the record high intersect. A break above this area would constitute a significant bullish development and could open the door to a continuation higher.

With that in mind, the series of lower-highs established throughout January will have to be disrupted if Bitcoin is to enjoy a meaningful recovery. Short of an advance above $36,000, a gradual bleed lower for Bitcoin in the near term seems likely.

How to Short Sell a Stock When Trading Falling Markets

Either way, the longstanding technical barriers above and below the current trading price offer locations for potential areas of interest or levels of invalidation depending on your directional bias. In the meantime, keep up to date on recent price developments and analysis using Twitter by following @PeterHanksFX.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX