Japanese Yen, AUD/JPY, CAD/JPY, NZD/JPY – Talking Points:

- Bearish RSI divergence hints at near-term pullback for AUD/JPY.

- CAD/JPY rates challenging key long-term downtrend resistance.

- NZD/JPY uptrend may be running out of steam.

The Japanese Yen has lost a significant amount of ground against its major counterparts in recent months and is at risk of further losses, as the haven-associated currency hovers precariously above sentiment-defining support. Here are the key levels to watch for AUD/JPY, CAD/JPY and NZD/JPY rates in the weeks ahead.

Japanese Yen Index** Weekly Chart – Perched Precariously Above 200-MA

JPY index weekly chart created using Tradingview

**JPY index averages EUR/JPY, CAD/JPY, GBP/JPY, AUD/JPY

The Japanese Yen could be at risk of extended losses against its major counterparts in the near term, as price hovers precariously above the sentiment-defining 200-week moving average and December 2019 low.

With the slopes of all three exponential moving averages notably steepening to the downside, and the MACD indicator tracking firmly below its neutral midpoint, the path of least resistance seems to favour the downside.

A convincing break below the 200-MA would probably intensify selling pressure and carve a path for price to probe the 2019 low. Clearing that likely brings confluent support at the 2018 low and 2007 uptrend into focus.

Conversely, a short-term rebound could be in the offing if the December 2019 low remains intact, with a push back above the 8-week EMA opening the door for JPY to claw back lost ground against its major counterparts.

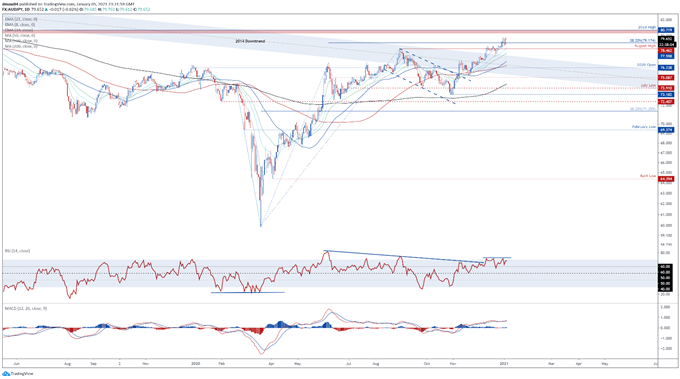

AUD/JPY Daily Chart – RSI Divergence Hints at Short-Term Pullback

AUD/JPY daily chart created using Tradingview

Although the longer-term outlook for AUD/JPY remains skewed to the topside, bearish RSI divergence suggests that the recent push higher is running out of steam.

Failing to gain a firm foothold above the psychologically imposing 80.00 mark could result in a short term pullback towards confluent support at the 8-day EMA and 38.2% Fibonacci (79.17).

Hurdling that probably opens the door for a more extensive pullback and brings the August 2020 high (78.46) into the crosshairs.

Alternatively, a daily close above 80.00 could signal the resumption of the primary uptrend and precipitate a challenge of the 2019 high (80.72)

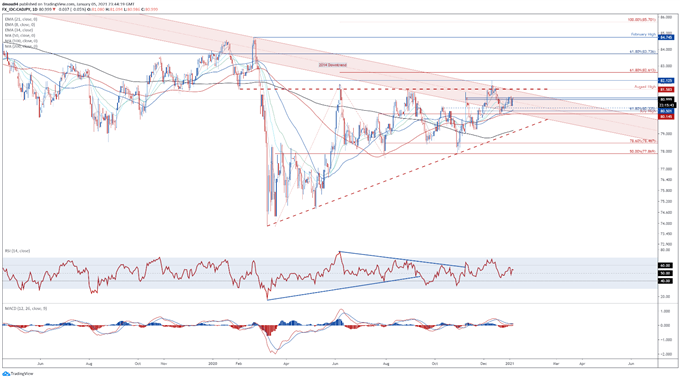

CAD/JPY Daily Chart – Probing Long-Term Trend Resistance

CAD/JPY daily chart created using Tradingview

CAD/JPY could be at risk of further losses in the coming days, as prices continue to probe the downtrend extending from the 2014 highs.

However, bullish moving average stacking, in tandem with both the RSI and MACD indicator holding firmly above their respective neutral midpoints, suggests the path of least resistance is higher.

Ultimately, a daily close above range resistance at 80.95 – 81.10 is required to bring the August high (81.58) into play. Breaching that probably triggers an impulsive topside push towards the December 2020 high (82.12).

On the other hand, sliding back below the 21-day EMA (80.82) could allow sellers to regain control of the exchange rate and drive price back towards the trend-defining 50-MA (80.40).

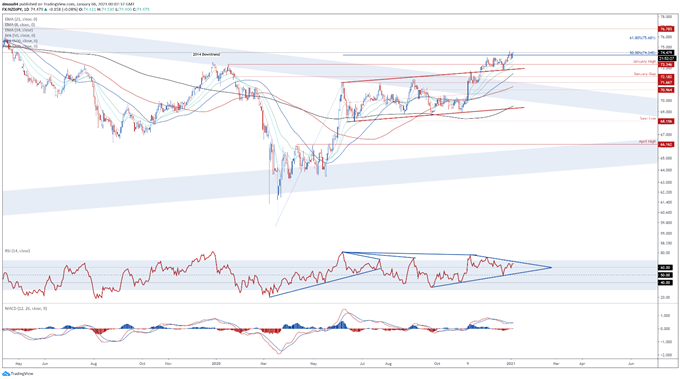

NZD/JPY Daily Chart – Uptrend Running Out of Steam

NZD/JPY daily chart created using Tradingview

NZD/JPY could also be at risk of a short-term pullback, as the RSI fails to confirm the recent push above resistance at the 50% Fibonacci (74.25).

That being said, with price tracking firmly above all six moving averages and a bullish crossover taking place on the MACD indicator, further gains are hardly out of the question.

A daily close above the December 2020 high (74.62) is probably needed to ignite a push to test the psychologically imposing 75.00 mark, with a break above carving a path to challenge the 61.8% Fibonacci (75.68).

On the contrary, failing to clamber over 74.50 could inspire a pullback towards the monthly low (73.80).

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss