MXN 1Q Forecast: Mexican Peso Outlook - USD/MXN Bearish in 2021 as Recovery Persists

The Mexican Peso looks positioned for a prolonged advance against the US Dollar in 2021. This could present bearish USD/MXN trading opportunities with the Mexican Peso possessing potential to extend its recent bout of strength. Constructive outlook for the Mexican Peso piggybacks on rising crude oil prices and normalizing measures of volatility, which correspond with the global economic recovery since COVID-19 first roiled markets. Moreover, this bearish USD/MXN theme largely follows encouraging vaccine developments in addition to likely implications of a Biden presidency.

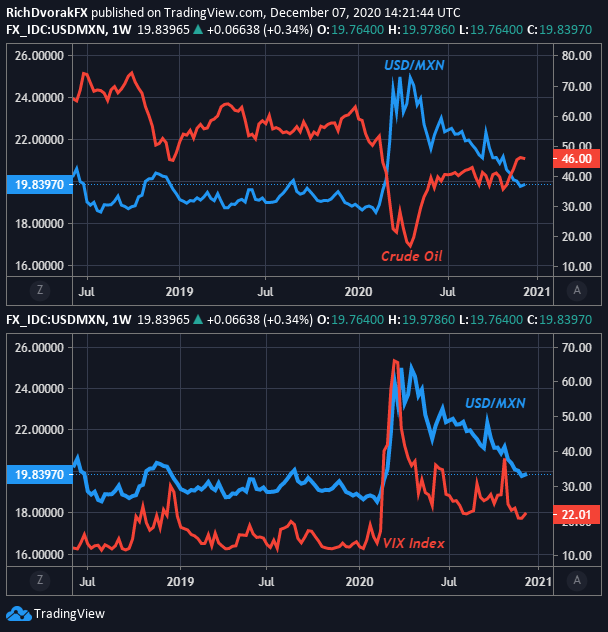

USD/MXN with Crude Oil & VIX Index: Weekly Time Frame (JUN 2018 TO DEC 2020)

Chart prepared by Rich Dvorak, created with TradingView

The Mexican Peso outlook is closely tied to the direction of crude oil prices seeing that Mexico’s budget has a hefty dependence on revenue from oil exports. With the Mexican Peso generally moving in tandem with crude oil, there could be potential for USD/MXN to fall further if the price of crude climbs higher. Also noteworthy is the positive relationship typically maintained by USD/MXN price action and the S&P 500-derived VIX Index.

The VIX ‘fear-gauge’ tends to rise during episodes of risk aversion, which presents headwinds to high beta emerging market currencies such as the Mexican Peso. On the other hand, spot USD/MXN often drops alongside the VIX Index as trader sentiment and risk appetite improve. Correspondingly, the Mexican Peso might continue to strengthen as sustained market optimism causes the VIX to bleed toward pre-pandemic lows.

USD/MXN Price Chart: Weekly Time Frame (MAR 2018 TO DEC 2020)

Chart prepared by Rich Dvorak, created with IG.

Additionally, with Mexico inflation running red-hot, Banxico could disappoint dovish expectations and fuel more Mexican Peso strength. To that end, spot USD/MXN price action might remain broadly under pressure over the weeks and months head. This brings to focus potential for USD/MXN to continue gravitating lower along its bottom Bollinger Band toward possible technical support underpinned by the 18.500-price level. If a Bollinger Band squeeze materializes, however, the Dollar-Peso might recoil higher. Nevertheless, the downward-sloping 20-week simple moving average highlights the standing bearish trend and possible area of technical resistance.