Brexit Outlook and Sterling (GBP/USD) Price, Analysis and Chart:

- A deal needs to be agreed upon by Sunday according to both sides.

- Sterling remains at risk.

Last night’s meeting between UK PM Boris Johnson and EU Commission President Ursula von der Leyen failed to break the current EU/UK trade talk deadlock and both sides agreed that deal, or the shape of a deal, should be found by Sunday. The three main areas of contention, fisheries, future governance and a level playing field remain. According to sources reports, talks will continue between the two negotiating teams and both sides agreed that by Sunday’ a firm decision should be taken about the future of the talks’.

As with all EU/UK deadlines, there is still the possibility that this will be kicked further down the road - as neither side wants to be seen to be the one walking away from talks - but with less than three weeks to go, Sunday may well be the final day of four tortuous years of discussions.

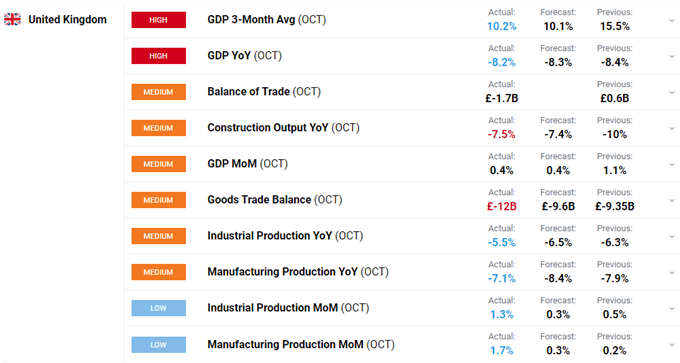

Earlier today, the Office for National Statistics released the latest UK growth data for October. Three-month average growth rose by 10.2% compared to forecasts of 10.1% and a prior reading of 15.1%, year-on-year GDP contracted by 8.2%, marginally better than forecasts of -8.3% and a prior reading of -8.4%. Industrial and manufacturing data also beat expectations and September’s numbers.

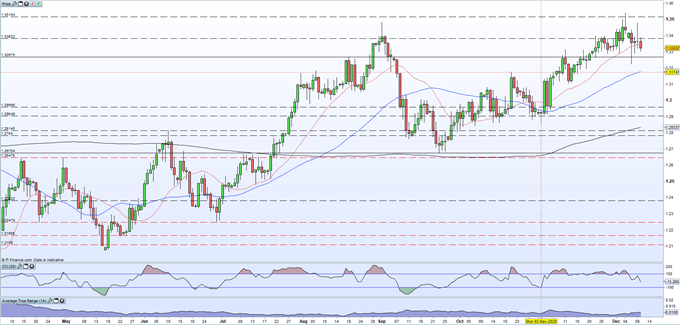

GBP/USD remains rangebound for now, seemingly brushing off the latest setback. The recent gentle uptrend has stalled and cable is trading in a rough 1.3225 – 1.3540 range with moves becoming more volatile this week. The 14-day ATR is around 108 pips and pressing a fresh one-month high, while cable is now back below the recently supportive 20-day simple moving average. If Sunday is the last day of talks between the EU and the UK, Monday morning’s price action will likely be extremely volatile. It may be wiser to go into this high risk event without any Sterling position.

Moving Averages Explained for Traders – Visit the DailyFX Educational Section for More Articles

GBP/USD Daily Price Chart (April - December 10, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentiment data show 37.03% of traders are net-long with the ratio of traders short to long at 1.70 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

Do you want to discover what kind of Forex Trader you are? Take the interactive DNA FA Quiz

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.