Japanese Yen Price Analysis & News

- Month-end flows to Weigh on the Japanese Yen

- USD/JPY Upside Risks Only in the Short Term

Month-end flows to Weigh on the Japanese Yen

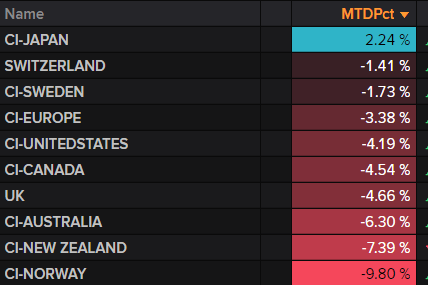

A strong start to the week for equity markets with upside potentially exacerbated from month-end flows, has kept the Japanese Yen on the backfoot. Additionally, given that Japanese equities had outperformed its G10 counterparts (Figure 1), month-end rebalancing flows are likely to weigh on the Yen, while various investment bank models tout USD buying. In turn, USD/JPY risks a move above the psychological 106.00 handle, while there are also upside risks in cross-yen.

Japanese Equity Outperformance Poses Risks to JPY

Source: Refinitiv

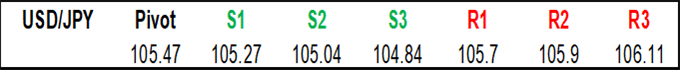

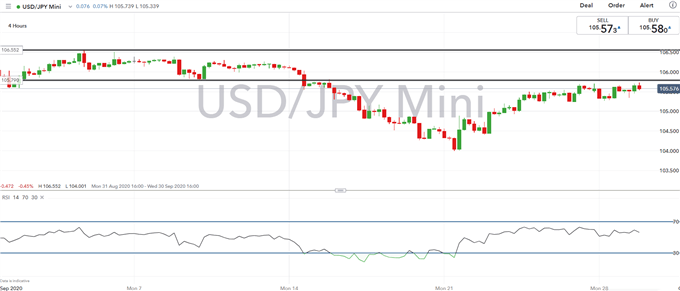

USD/JPY Technicals

On the topside, resistance is situated at 105.80, where a break above opens the doors for a move towards 106.50. That said, we see upside risks in the short term for USD/JPY, given that uncertainty tied to the US election will remain and thus we expect USD/JPY to resume its downtrend post month-end rebalancing. On the downside, key support resides at 105.20-30.

USD/JPY Price Chart: 4-Hour Time Frame

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |

Source: IG