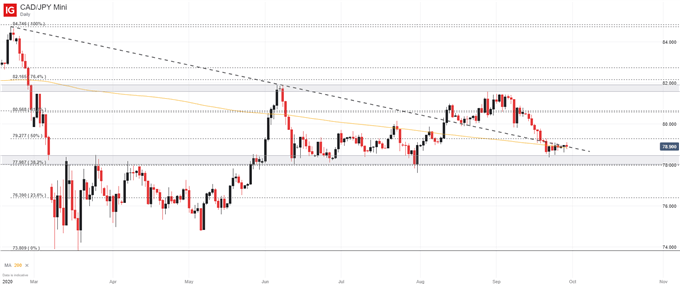

CAD/JPY Price Outlook:

- CAD/JPY has fallen alongside equity markets in September as risk aversion weighs on CAD

- Declines have pushed the pair to test major support near the 200-day moving average

- US Dollar Price Forecast: USD Pulls Back as US Data Releases Begin

Canadian Dollar Forecast: CAD/JPY Hovers Over Major Support

Secondary covid lockdowns, political uncertainty and seasonality have eaten away at risk appetite in September, leading to declines in growth-sensitive markets like US equities and the Canadian Dollar. While the Canadian Dollar has not suffered across all crosses, weakness has been widespread when it is paired with a counterpart like the US Dollar, Euro or Japanese Yen which are less reliant on economic growth.

CAD/JPY Price Chart: Daily Time Frame (March 2020 - September 2020)

Of USD/CAD, EUR/CAD and CAD/JPY, only Japan has avoided another round of covid lockdowns, a factor that may have eroded growth forecasts elsewhere. Unsurprisingly then, CAD/JPY has suffered throughout September, falling from resistance near the 81.50 mark to the 200-day moving average near 78.83. After probing the line for days, the pair has only been able to stay above the level after employing the assistance from potential support at 78.45 to 78.00.

Suffice it to say, CAD/JPY appears exceedingly weak at this stage and runs the risk of further declines. To be sure, the 200-day moving average will attempt to keep price afloat, but the line in the sand at this point in time may rest at the 78.00 mark. If pierced, CAD/JPY might extend lower still as major support is almost nonexistent until 76.39.

Top 8 Forex Trading Strategies and their Pros and Cons

On the other hand, a renewal in risk appetite – as hinted at over the last few sessions – could deliver the lifeline necessary to revive CAD/JPY at this juncture. If bulls return, initial resistance may exist at the 79.26 mark. Still, relying on an abrupt recovery rally is rather presumptuous. Either way, the positioning of the pair creates an intriguing landscape for trade set ups, primarily those which cater to break out trading. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX