GBP/USD Price Outlook:

- GBP/USD fell significantly last week as Brexit uncertainty undermined the British Pound

- Can support halt the Pound’s decline, or will Brexit uncertainty drive GBP/USD lower still?

- DAX 30, FTSE 100, CAC 40 Forecasts for the Week Ahead

GBP/USD Price Forecast: Retail Traders Confident Worst has Passed

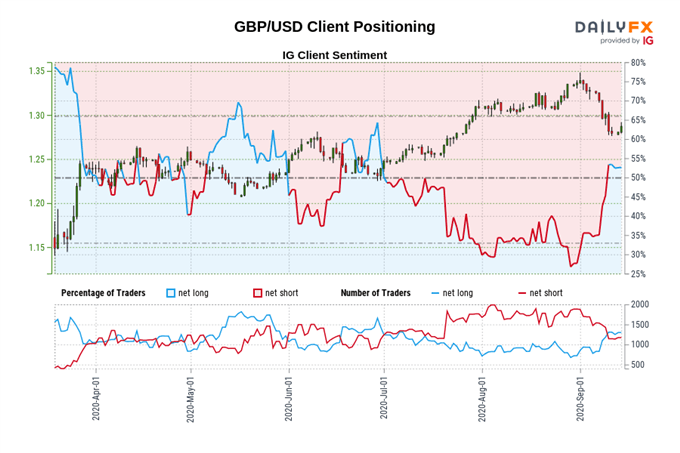

September has seen the British Pound unravel as renewed Brexit uncertainty erodes confidence in the country’s currency and equity markets. After sliding from 1.3482 in early September to probe 1.2800 this week, sentiment surrounding GBP/USD has undergone an about-face and retail trader positioning is beginning to show some traders believe the worst has passed. With Brexit news due for release and Cable resting on support, where do IG clients think GBP/USD is headed?

GBP/USD Price Chart & Client Positioning Data

To be sure, IG client sentiment data reveals a recent shift in net positioning as traders transition from a bearish bias to a bullish one. The change in positioning follows the abrupt turn lower as bulls secure a slight majority just as GBP/USD probes possible support around 1.2800. Since retail traders often attempt to call perfect tops and bottoms, the uptick in long exposure is rather unsurprising at this juncture. Further still, days of losses may lead some traders to believe the Pound is oversold.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -2% | 4% |

| Weekly | 29% | -6% | 13% |

Regardless of its technical details, uncertainty looms large for the pair, as does event risk. Coupled with our contrarian stance on IG client sentiment data, calling for a recovery rally may be presumptuous at this stage and GBP/USD looks vulnerable to a continuation lower. Thus, patience may be warranted for bulls until Brexit clarity is delivered and event risk is reduced as Prolonged Brexit uncertainty looks to erode the British Pound further.

GBP/USD Price Chart: Daily Time Frame (February 2019 – September 2020)

Since support beneath 1.2800 appears rather sparse, an extension lower could see the pair tumble toward the 200-day moving average - currently trading around 1.2659 - as it grasps for assistance. Whatever the eventual outcome may be, retail traders have conducted quite the shift in recent days, but it is not without considerable risk. While the market awaits Brexit news, follow @PeterHanksFX on Twitter and check back at DailyFX.com for Brexit updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX