S&P 500, ASX 200, GOLD PRICE OUTLOOK:

- S&P 500 index surged 2%, with 78% of the index components ending higher

- Australia’s ASX 200 index may follow strong US leads, testing a psychological resistance at 6,000

- Gold prices rebounded from a key support level at US$ 1,910; MACD signals a “Bullish Reversal”

S&P 500Index Outlook:

The S&P 500 index jumped over 2% as traders shrugged off a three-day selloff and started buying the dips. Encouragingly, over 78% of the index components ended the day higher. This contrasts an average of 30-40% stock gains observed before the recent market rout and suggests improving sentiment. New York City has planned to resume indoor dining at 25% capacity at the end of this month, painting a silver lining of the coronavirus situations.

The volatility index (VIX) tumbled and the US Dollar index retraced from a one-month high – showing that market participants have calmed down and their risk appetite is perhaps picking up.

Traders are eyeing on today’s ECBmeeting and interest rate decision for clues about how the central bank plans to counter the Covid-19 complications. With recent rising Covid-19 cases and falling inflationin the EU, there seems to be a good chance for ECB to ease further. This scenario will likely to weaken the Euroagainst its major peers. The opposite scenario, however, will likely result in the reverse.

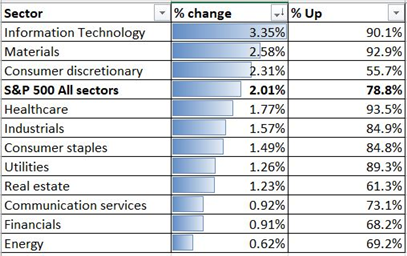

Sector wise, information technology (+3.35%), materials (+2.58%) and consumer discretionary (+2.31%) were among the best performers. This showed a clear “risk on” pattern and might inspire similar trading activities across the Asia-Pacific region today.

S&P 500 Index Sector performance 9-9-2020

Source: Bloomberg, DailyFX

Technically,the S&P 500 index has rebounded from the lower bound of the “Ascending Channel” as shown in the chart below. An immediate resistance level can be found at 3,400 – the 100% Fibonacci extension. Breaking this level will open the room for further upside towards 3,533 – the 127.8% Fibonacci extension. The MACD indicator remains in bearish set-up, but it could reverse if market starts to stabilize.

S&P 500 Index – Daily Chart

ASX 200 Index Outlook:

Australia’s ASX 200 index looks set to rebound alongside Asia-Pacific markets following strong US leads. A weaker USD is boosting commodity prices, and thus may underpin Australia’s commodity sector.

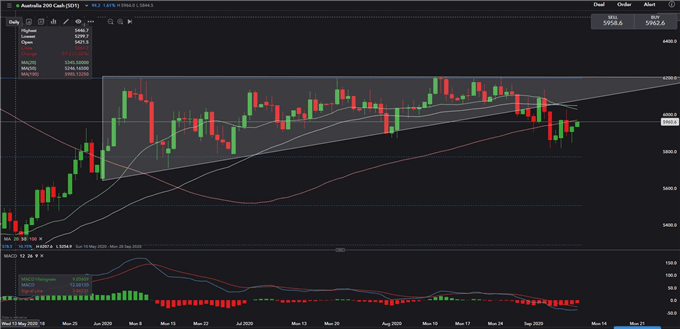

Technically, the ASX 200 index has broken the “Ascending Triangle” last week and has since struggled to find a clear direction. The near-term momentum is biased towards the downside as suggested by the “Death Cross” formed by the 20- and 50-Day Simple Moving Average (SMA) lines. An immediate resistance level can be found at 6,000, which is also a phycological level.

ASX 200 Index – Daily Chart

Gold Price Outlook:

A weakening US Dollar and improving market sentiment is propelling gold prices, which climbed to US$ 1,947 at Asia open. We observed that gold’s safe-haven status is fading nowadays and it occasionally exhibited positive correlation with risk assets.

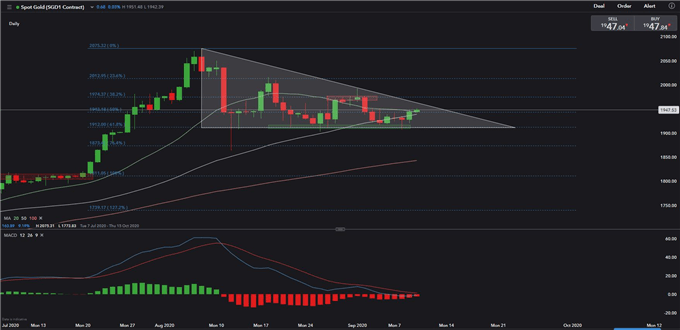

Technically, Gold prices have rebounded from a key support level at US$ 1,910. Its daily price has formed a “Descending Triangle” , which is a consolidating pattern. The MACD indicator, however, has likely stabilized and posit for a potential “Bullish Reversal” – selling pressure seems to be depleting and the momentum is leaning upwards.

Gold Price – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter