Crude Oil Price Outlook:

- Crude oil suffered large losses on Monday, sending the commodity to its lowest level since June

- Risk appetite has receded in recent days as traders seem to shy away from hot investments

- Nasdaq 100, Dow Jones, S&P 500 Forecasts: Tech Stocks Falter, Lead Selloff

Crude Oil Price Forecast: Crude Falters Alongside Tech as Selloff Broadens

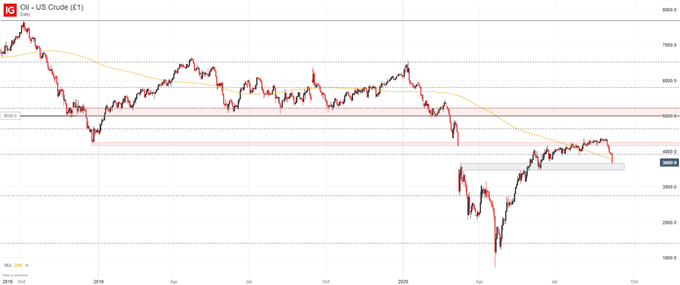

Crude oil prices fell more than 7% on Monday as the West Texas Intermediate blend slumped to its lowest level since mid-June. Trading beneath $37 a barrel, crude suffered a key breach beneath the 200-day moving average which could open the door to further losses. Apart from the technical concerns, risk-sensitive investments have experienced drastic losses in recent days and the weakness in crude oil could suggest a broader reversal in risk assets is a possibility.

Crude Oil Price Chart: Daily Time Frame (October 2018 – September 2020)

While crude oil has yet to reclaim its pre-covid levels, it can be argued recent bullish sentiment in the tech sector has been a quiet tailwind for the commodity. Now as technology begins to falter, other risk assets like crude oil and lumber have begun to show similar signs of weakness. Thus, there are symptoms risk aversion has spread from an isolated number of hot technology stocks like Tesla and Apple to other markets entirely.

A Guide to Support and Resistance Trading

With that in mind, the risk of a broader pullback in the stock market and risk assets like the Australian Dollar may be on the rise. As it stands, the narrative in financial news media has been the high-flying work from home stocks leading the plunge, but if the market experiences continued weakness in other areas, losses in the leading technology stocks might be just the beginning.

Either way, crude oil will look to hold above possible support around the $36.61 mark which coincides with the top of the gap-lower established in the March plunge. Should it fail, secondary support may reside slightly beneath, near the $34.71 level. Together, the technical barriers might look to keep price afloat, but losses may be difficult to shrug off if weakness in other risk assets continues. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX