EUR/USD Price Analysis & News

- Reality Check for EU Recovery Optimists

- EUR/USD Dives on Eurozone PMI

Reality Check for EU Recovery Optimists

The Euro is on the backfoot following broadly weaker than expected Eurozone PMI survey’s. Most notably the French PMI which posted a big miss across the board with the manufacturing sector moving back into contractionary territory. IHS Markit noted that the expansion in new orders had slowed to a snail’s pace, while there had been a reacceleration in the rate of job cutting. Meanwhile, German PMIs were more mixed with the manufacturing sector showing a slight improvement, partially offsetting the weakness observed in the services sector with Germany. That said, as I had alluded to following yesterday’s ECB minutes, caution is required for being married to the “Euro”phoria narrative.

EUR/USD Reaction to French and German PMI’s

Source: IG

Risk-Reward Favours a EUR/USD Pullback.

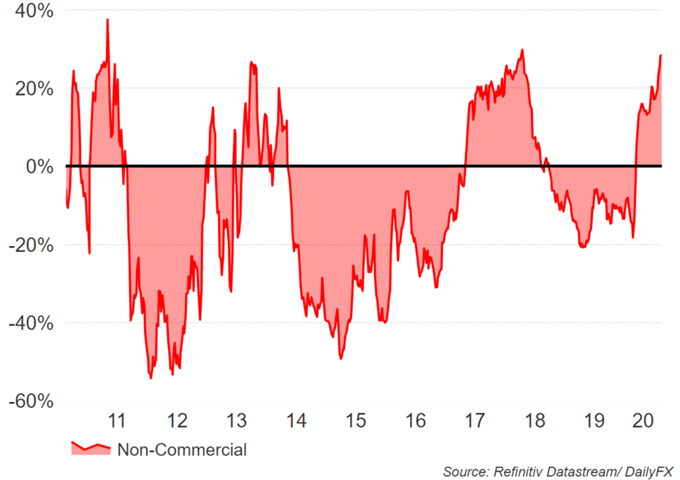

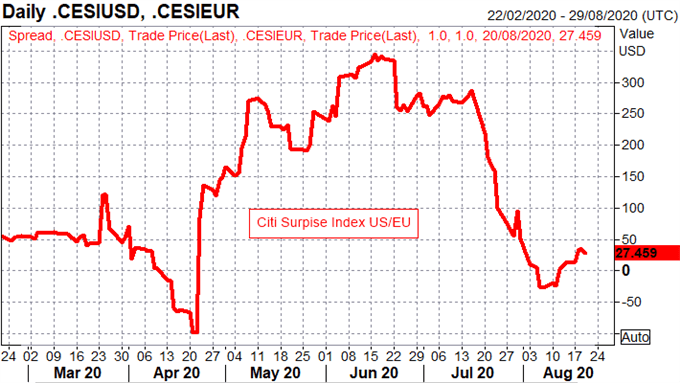

Another factor that the EU has to contend with is the tedious trade negotiations with the UK, which thus far has shown little in the way of material progress. In turn, over optimism regarding a notable EU recovery should be treated with caution, particularly as EU fiscal stimulus has largely been priced in. That in mind, as bullish positioning in the Euro a crowded trade, risk-reward favours a pullback in the Euro against the depressed US Dollar. Alongside this, with the US/EU data surprise spread beginning to move in favour of the US, upside in the Euro may be hard to come by as little interest has been shown above 1.19.

Euro Bullish Trade is Crowded