DOW JONES, NIKKEI 225, HANG SENG INDEX OUTLOOK:

- The Dow Jones rebounded overnight after the release of poorer-than-expected jobless claims

- The Nikkei 225 and Hang Seng index mayrebound with the broader Asia-Pacific markets

- The US Dollar Index (DXY) retraced on poor job data, sending gold prices higher

Dow Jones Index Outlook:

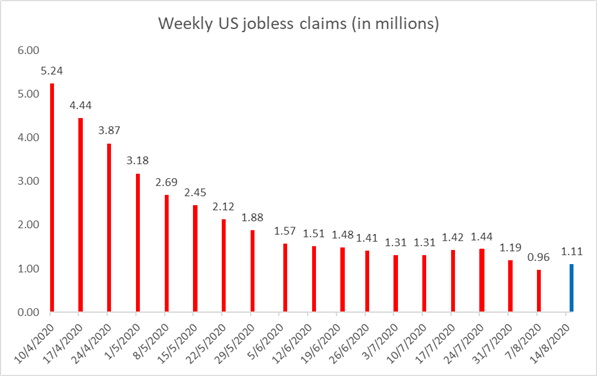

The Dow Jones Industrial Average had a V-shaped rebound on Thursday, following the release of a worse-than-expected weekly US jobless claims figure. The data came in at 1.106 million, higher than a 0.925 million forecast. This underscores a fragile jobs market and adverse impact brought by the Covid-19 pandemic.

The US Dollar index fell to 92.67 from 93.26 as investors likely adjusted the inflation prospects on the employment data, which may lead to a more dovish-biased Fed in the month to come. As the Dollar fell, precious metals and the Treasuries climbed.

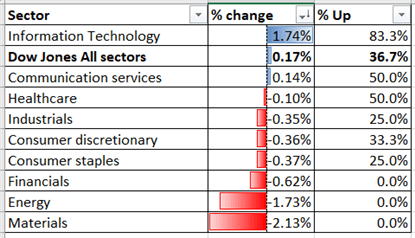

It is also worth noting that 63% of the Dow Jones components, and around 70% of the S&P 500 Index components ended lower on Thursday. This is despite that both indices closed higher – an unbalanced pattern that highlights the risk of a potential stock market pullback.

Sector-wise, information technology (1.74%) and communication services (+0.14%) were doing the heavy-lifting, whereas the other seven sectors closed lower. Materials (-2.13%), energy (-1.73%) and financials (-0.62%) were among the worst performers.

Dow Jones Index Sector performance 20-8-2020

Source: Bloomberg, DailyFX

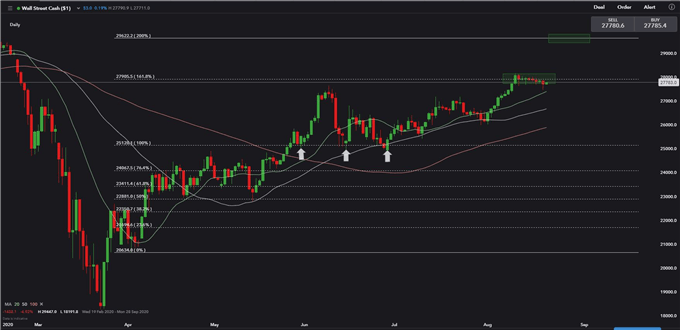

Technically, the index is facing strong resistance at 27,900 – the 161.8% Fibonacci extension. The Dow has been testing this level for nine consecutive trading sessions without a meaningful break through. Pushing above 27,900 will likely make room for further upside towards the 200% Fibonacci level at 29,600 (chart below).

Dow Jones Index – Daily Chart

Nikkei 225 Index Outlook:

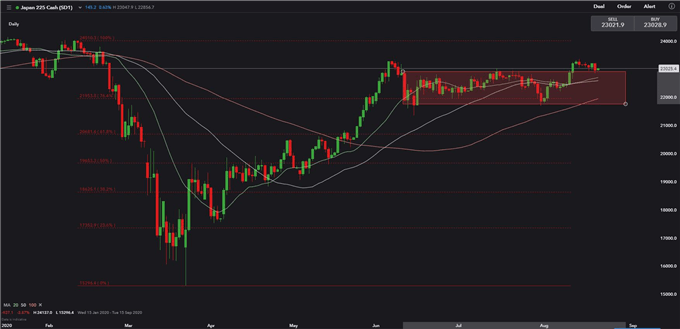

Japan’s Nikkei 225 stock benchmark (Nikkei 225) may rebound alongside the broader Asia-Pacific market on Friday, as suggested by the futures market.

Technically, the Nikkei 225 has broken above a rangebound zone between 21,700 to 22,900 last week. The 22,900 resistance level has now became its immediate support zone. The overall trend remains bullish-biased, as suggested by its 20-, 50- and 100-Day Simple Moving Averages (SMAs).

Nikkei 225 Index – Daily Chart

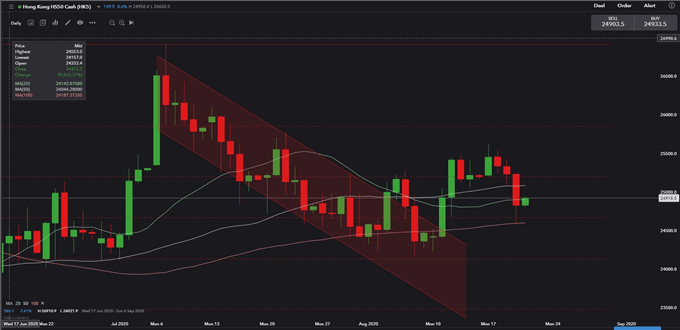

Hang Seng Index Outlook:

Hong Kong’s Hang Seng Index (HSI) stock benchmark may climb mildly on Friday, following positive leads from the Wall Street overnight. The technology sector may continue to outperform the benchmark index and move higher, led by Tencent, Alibaba, JD.com and Xiaomi. In contrast, financial names including HSBC, AIA and Pingan Insurance are likely to underperform against the backdrop of a low interest rate environment and poor macroeconomic conditions.

Technically, the HSI has found an immediate support at 24,600 – the 50% Fibonacci retracement level. It may continue to range between 24,600 to 25,200 (the 38.2% Fib) in the days to come, until the review of the phase-one US-China trade talk clears the political skies.

Hang Seng Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter