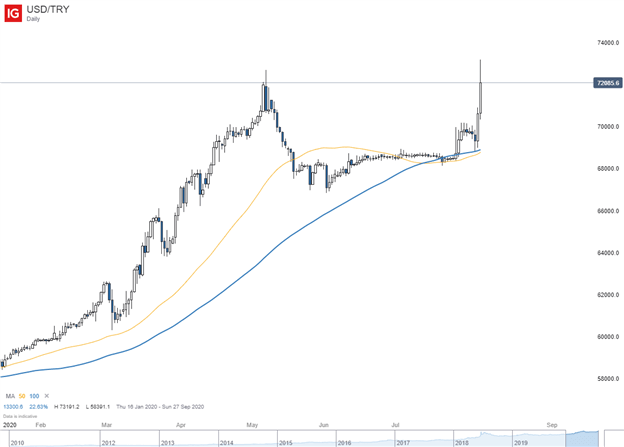

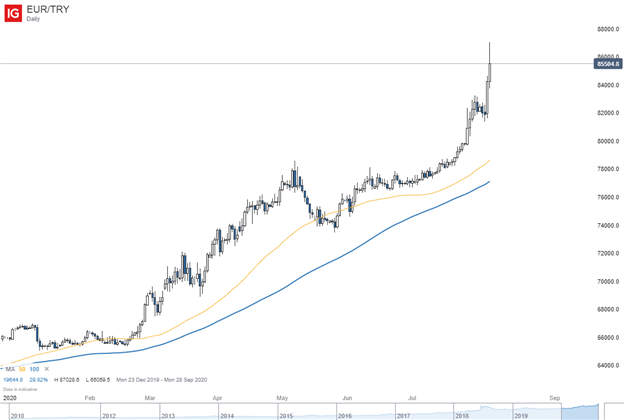

Turkish Lira, USD/TRY, EUR/TRY Talking Points:

- Turkish Lira sinks as USD/TRY, EUR/TRY rise to record high

- Money market distress preceded Lira volatility

- Pandemic pressures exert further pressure on FX reserves

The Turkish Lira fell to an all-time low versus the US Dollar and Euro on Thursday following disruptions in Turkey’s money markets, along with an already shaky fundamental backdrop. USD/TRY and EUR/TRY were trading over 3% higher in Thursday’s session, and year-to-date, both currency pairs have appreciated north of 20%.

USD/TRY Daily Price Chart

Source: IG Charts

As previously mentioned, money market disruptions appear to be a primary driver behind the sudden decline in the Lira, as overnight borrowing costs hit record highs earlier this week. While the soaring interest rate on swap transactions remains the probable precursor, the fundamental backdrop for the once beloved EM currency has deteriorated substantially following the COVID-19 pandemic.

EUR/TRY Daily Price Chart

Source: IG Charts

Since the pandemic and the resulting economic fallout, Turkey has increased its currency intervention measures to pin the Lira under seven per dollar. Given the current pricing, these efforts appear insufficient, for now. Consequently, these measures possibly depleted Turkey’s FX reserves further, which may put continued pressure on the Lira in the short-term. According to the latest external sector report from the IMF, Turkey’s net international reserves dropped to $26 billion USD since the start of the year.