AUD/USD Analysis:

- AUD/USD has continued its impressive rise since the March low buoyed by increasing commodity prices and a softer dollar

- Should the current momentum continue, the Aussie Dollar could be within striking distance of the yearly high as the focus shifts to US NFP data on Friday

- IG Client Sentiment data shows nearly 60% of traders remain short amid surge in daily and weekly longs

Aussie Dollar Eyes Yearly High Should Bullish Run Continue

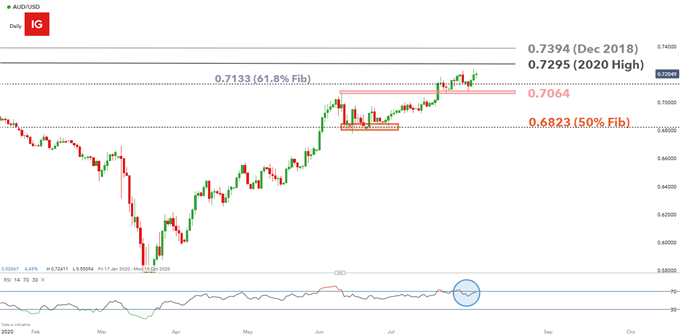

The Australian Dollar has enjoyed a prolonged bullish run, buoyed by rising commodity prices and a weaker US Dollar. The pair surged above the June swing high (0.7064) and the 61.8% Fib level (drawn from the 2018 high to the 2020 low) and now looks the next area of potential resistance at 0.7295 – the yearly high.

NFP data on Friday has the potential to increase volatility in the pair as the American economy struggles to reduce unemployment however, estimates suggest 1.6 million jobs are to have been created in July.

AUD/USD Daily chart

Chart prepared by Richard Snow, IG

US Dollar Poses Potential Challenge for Aussie Bull Run

While the Australian Dollar has strengthened against the US Dollar, the greenback is at a crucial juncture as it looks to hold above the recent area of resistance of 9250 as the RSI edges closer to breaking above the oversold zone, which has not occurred yet.

AUD/USD Key Technical Levels

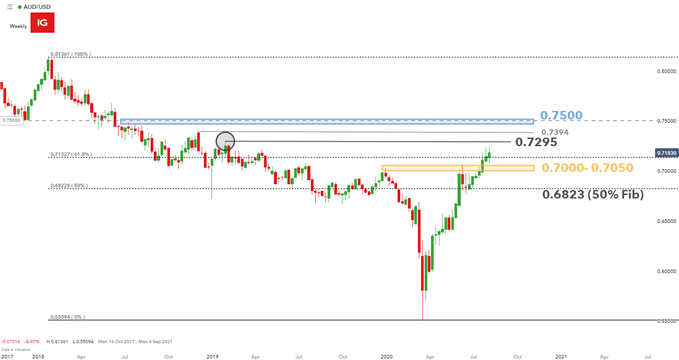

Should the 9250 level hold for the DXY, AUD bears may halt or apply downward pressure to the current AUD/USD bullish move. A turn lower for the pair brings the 61.8% Fib level back into focus and potentially the 0.7000 psychological level.

On the other hand, should DXY break down below 9250 it then brings into play the 9200 psychological level which may turn out to be supportive of a further advance in AUD/USD. Areas of potential resistance for Aussie bulls include the yearly high of 0.7295, followed by the 0.7394 swing high and potentially the 0.7500 psych level.

AUD/USD Weekly Chart with Key Levels

Chart prepared by Richard Snow, IG

IG Client Sentiment Not Ruling Out a Reversal

- At the time of writing, AUD/USD retail trader data shows 40.40% of traders are net-long with the ratio of traders short to long at 1.48 to 1

- When operating with a contrarian view with respect to IG Client Sentiment, the fact traders are net- short suggests AUD/USD prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

- The number of traders net-long is 14.00% higher than yesterday and 11.36% higher from last week, while the number of traders net-short is 1.32% lower than yesterday and 0.42% higher from last week.

- Traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

https://www.dailyfx.com/sentiment