HANG SENG INDEX, CHINA A50 INDEX, GOLD PRICE OUTLOOK:

- Financial sector led a decent rebound in Hang Seng, which is now facing a resistance at 25,000.

- China A50 index climbed to its 23.6% Fibonacci retracement at 15,400 as US stocks rose

- Gold prices broke US$ 2,000 for the first time in history, as the US Dollar fell

Hang Seng Index Outlook:

Hong Kong’s Hang Seng index (HSI) stock benchmark rebounded 2% yesterday with higher trading volume, as the financial sector jumped 2.37%. AIA (+4.1%), Tencent (+2.04%), CCB (+2.64%) were among the biggest contributors to the index’s gains. Besides, technology shares not included in the HSI registered strong gains, including Meituan (+8.67%), Alibaba (+3.34%), Xiaomi (+3.2%) and JD.COM (+1.94%). Expectations for the launch of the Hang Seng Technology Index, which is perceived to be China’s equivalent of the Nasdaq, has boosted technology shares recently.

The Wall Street stocks registered another upbeat session last night, which may send positive cues to Asia-Pacific’s opening. The rally in gold prices and treasury futures, however, signaled rising demand for safety as the ongoing virus relief stimulus talks in Washington seems to have stalled.

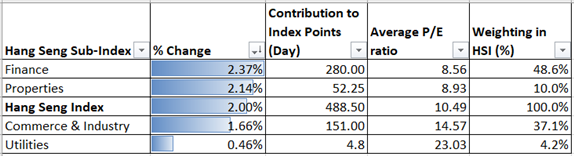

Sector-wise, finance (+2.37%) and properties (+2.14%) were leading whist utilities (+0.46%) and commerce & industry (+1.66%) were lagging.

Hang Seng Sector performance 4-8-2020

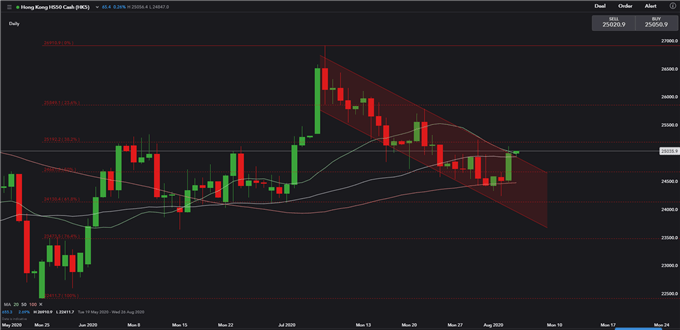

Technically, the Hang Seng Index attempted to break out of its ‘descending channel’ as shown in the chart below. It has also reached a phycological resistance level at 25,000. The downward sloped 100-Day Simple Moving Average (SMA) line may also exert some selling pressure at around that level. A meaningful break above this level would likely lead to a trend reversal and open room to more upside potential.

Hang Seng Index – Daily Chart

FTSE China A50 Index Outlook:

China A50 futures edged higher after a strong US trading session, extending its gains for a fifth day. The recent rally in the Shanghai and Shenzhen composites has likely slowed down as profit-taking activities kicked in.

Today’s release of the Caixin PMI readings will help to paint a clearer picture of China’s economic activities, especially in the service sector. The Caixin Manufacturing PMI released earlier this week came in at 52.8, beating a consensus forecast of 51.3 and also registering its highest reading in a decade.

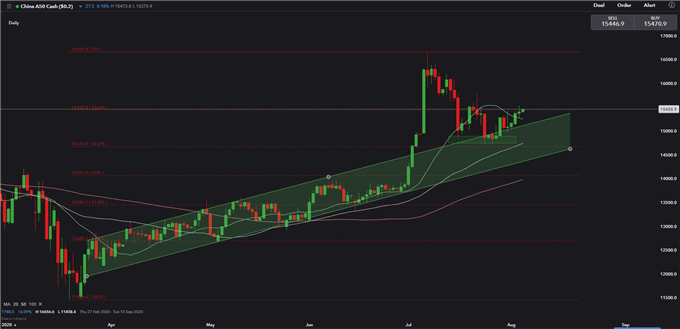

Technically, the index has likely arrived a key resistance level at 15,400 – the 23.6% Fibonacci retracement. Breaking this level will likely open room for potential upside towards 16,500.

FTSE China A50 Index – Daily Chart

Gold Prices Outlook:

Gold prices scrapped resistance at US$ 2,000 and moved higher to US$ 2,020 – a record high. A weakening US Dollar and uncertainties surrounding the US stimulus package were among the drivers behind the move, but we should bear in mind that historic monetary easing is the long-term catalyst for precious metal prices.

Technically, it is difficult to establish a clear resistance level when prices are at record highs. The trend is likely to remain bullish until it reverses. The key question is when. The RSI indicator has been traveling at extreme overbought levels for two weeks, suggesting a technical pullback may happen any time.

Gold Prices – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter