HANG SENG INDEX, NIFTY 50 INDEX, GOLD PRICE OUTLOOK:

- Hong Kong stock market reopens after holiday; 25,000 remains a key resistance for Hang Seng Index

- India Nifty 50’s upward trajectory remains intact, despite surging virus cases

- Gold price rebounds as dollar index falls. Technical indicators suggest more upside to come

Hang Seng Index Outlook:

Asia Pacific investors woke up on Friday morning with a string of macro and political headwinds. These include a weaker-than-expected US initial jobless claims data, a surge in local coronavirus cases - which led Texas to halt reopening - and a sanction bill over Hong Kong’s autonomy passed by the Senate which is perhaps adding to the sour tone.

The US Senate has passed a bill that would put sanctions on Chinese officials who erode Hong Kong’s limited autonomy from Beijing, as well as the banks and firms that do business with them, according to Bloomberg news. This bill will likely do no good to improve the US-China relationship, which has deteriorated over the past few months due to trade and virus disputes. Things might get worse if Beijing decides to retaliate against the Hong Kong bill.

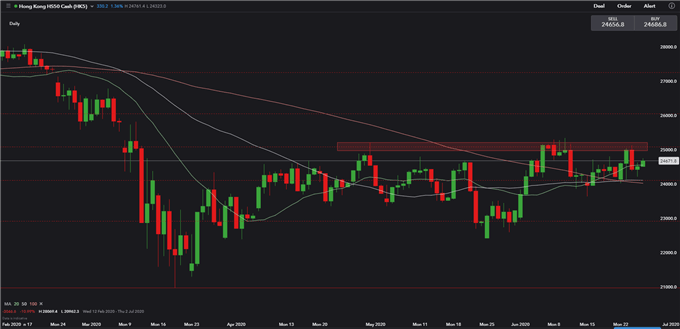

The Hang Seng Index, the local stock market benchmark, is likely to open at around 24,700, according to futures markets. The index faces an imminent resistance level at 25,000, which it failed to break out earlier this week. Sentiment across the greater China market could remain fragile despite a decent rebound on Wall Street overnight. The Hong Kong stock market resumes trading after the Tuen Ng Festival Thursday. Mainland China stocks are shut until Monday.

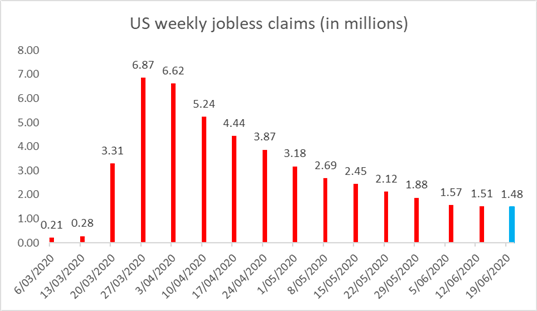

Last night, US weekly jobless claims data disappointed investors with a higher-than-expected reading. 1.48 million people filed for unemployment claims, higher than economists’ forecast of 1.3 million. It suggests a recovery in the US labor market is slower than expected, and it remains fragile amid virus resurgences.

The S&P 500 index rebounded 1.10% to 3,083. Sector-wise, financials (+2.71%), energy (+1.92%), information technology (+1.3%), and materials (+1.3%) were among the best-performing sectors.All sectors ended higher with the exception of utilities (-1.22%).

Data Source: Bloomberg

Hang Seng Index –Technical Analysis

The Hang Seng Index is challenging a key resistance level at 25,000, which it failed to break out above in early May, June and this week. The 20-day SMA (simple moving average) has crossed above its 50- and 100-Day SMA, signaling a formation of a ‘golden cross’ should the price hold above 24,000. An immediate support level could be found at 24,100 – the 38.2% Fibonacci extension level.

Hang Seng Index – Daily Chart

Nifty 50 Index Outlook:

India’s Nifty 50 Index stock market benchmark is set to rise alongside a broader market. Its upward trajectory remains intact but fundamental headwinds amid rising local virus cases might call for a sense of caution.

“The Nifty 50 could be particularly vulnerable with local cases rising fairly aggressively, both over a daily and weekly basis. In fact, India has become one of the more recent hotspots. This could undermine local economic recovery bets if measures have to be taken to reinstate lockdowns”

“This is as ratings agencies (Moody’s, Fitch, S&P) hold the nation’s credit rating just a tick above junk status. Consumption is slowly picking back up, but this is after local carmakers sold zero vehicles to retailers back in April.”, - according to Daniel Dubrovsky, an analyst of DailyFX.

Technically, the Nifty 50 remains in an ‘Ascending Triangle’ on the daily chart, with immediate resistance level found at 10,500 – the 61.8% Fibonacci retracement. Breaking out above this ceiling will open room for more upside towards 11,200 – the 76.4% Fibonacci retracement. The MACD has likely diverged from the price, which suggests momentum is skewed more heavily to the downside.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

Gold Price Outlook:

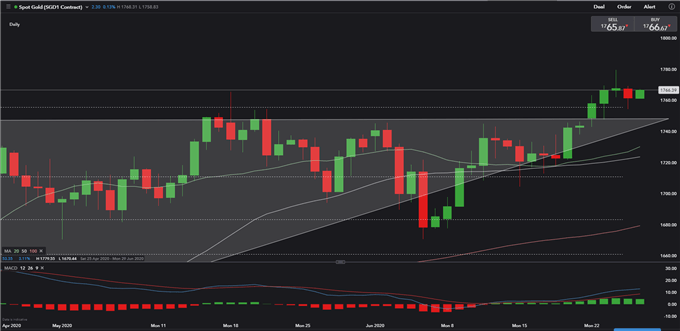

Gold price has recently broken out above its ‘Ascending Triangle’ and cleared a key resistance level of US$ 1,750. Its price rose to US$ 1,765 this morning, thanks to a falling US Dollar. Concerns over a global virus resurgence and uncertainties surrounding the US-China relationship following the Hong Kong sanction bill may boost the demand for safety, and thus benefit safe havens like gold and the Japanese Yen.

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter