EUR/USD Price and PMI Data, News and Analysis:

- French manufacturing PMI hits a 21-month high.

- EUR/USD respects technical support and eyes resistance.

EUR/USD Short-Term Rally Remains in Place

The latest set of Markit PMI releases for June show economic activity picking up in the Euro-Zone as a loosening of lockdown conditions boosts economic activity. The French releases all pushed back above the 50 level, the divide between contraction and expansion, with the manufacturing index hitting its highest level in 21-months. The German data, while rebounding from April’s low, points to activity growing but at a more subdued rate with ‘firms starting to feel a bit more bullish about the outlook’ although concerns about the jobs market remain. According to IHS Markit, the flash Euro-Zone PMIs indicated ‘another substantial easing of the region’s downturn in June ‘ and while output and demand are still falling they are no longer collapsing.

According to chief business economist Chris Williamson, ‘However, with the timing of a return to normal still something that can only be speculated upon, and virus-related restrictions likely to continue to hit many businesses for the rest of the year, we remain very cautious of the strength and sustainability of any economic rebound’.

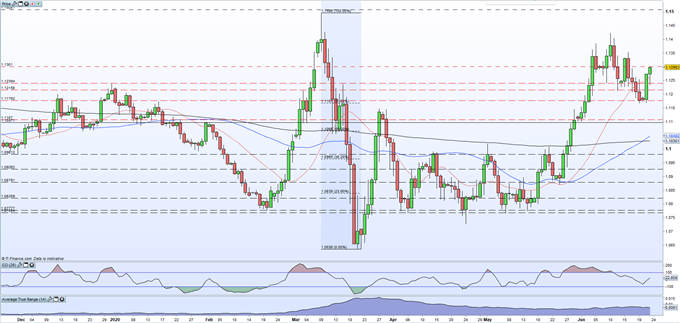

EUR/USD continues Monday’s push higher and this week’s move has broken a series of lower highs and lower lows that weighed on the pair. EUR/USD also produced a textbook bounce of the 61.8% Fibonacci retracement level around 1.1167 and this is likely to provide support again in the case of any sell-off. Chart resistance levels are seen around 1.1353 and 1.1400 before the June 10 multi-week high at 1.1423 comes into view.

EUR/USD Daily Price Chart (December 2019 – June 23, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -6% | 6% | 0% |

| Weekly | -20% | 45% | 2% |

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.