Silver Prices, Copper Futures, Jerome Powell Testimony – TALKING POINTS

- Silver prices trading at intersection of resistance at uptrend: which will break?

- Copper futures trading in a compression zone between resistance and uptrend

- What would a decline in the base metal reveal about the fundamental outlook?

Silver Price Outlook

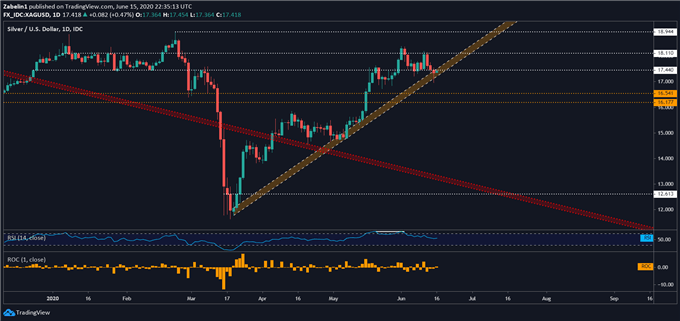

Silver prices have enjoyed a 45 percent ride after bottoming out in March, though recent price action suggests the pair’s remarkable ascent may be showing early signs of a broader pullback. In late-May, silver prices -re-entered a congestive ranging back to late-2019 between 17.440 and 18.110 and have remained constrained by those bands once again.

XAG/USD – Daily Chart

XAG/USD chart created using TradingView

This puts the precious metal at an important crossroads as it trades between the lower tier and the March uptrend. If 17.440 holds, the invalidation of the slope of appreciation could catalyze an aggressive pullback. In this scenario, XAG/USD could encounter some downside friction at an inflection range marked by the 16.541-16.177 price parameters.

Copper Price Forecast

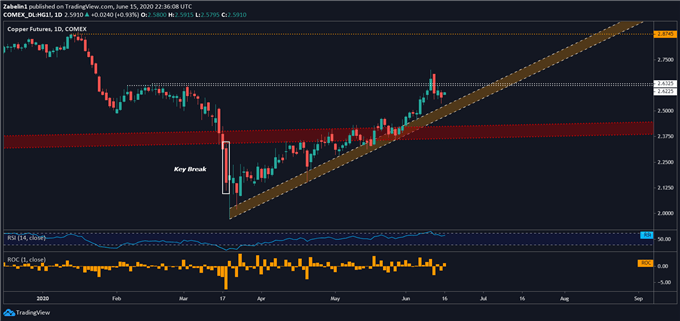

Copper futures continue to climb along the uptrend formed back in March after the selloff in global equities hit a bottom. However, the base metal’s false breakout above a key resistance range between 2.6325 and 2.6225 could mean a fatal retest of the slope of appreciation. This test is an inevitably considering the range between it and the aforementioned resistance range is narrowing: something’s got to give at some point.

Copper Futures – Daily Chart

Copper Futures chart created using TradingView

Breaking below the uptrend could open the door to retesting the 17-year uptrend copper prices have shattered at the height of the panic-induced selloff at the end of Q1. Due to copper’s wide-use across a variety of cycle sensitive industries like industrial production and housing construction, its decline below a key technical level may also carry significant implications for the fundamental outlook.

Fed Chairman Jerome Powell Testimony

Later today, Federal Reserve Chairman Jerome Powell will be testifying in front of the Senate Banking Committee as part of its Semiannual Monetary Policy Report to the Congress. Commentary there could rattle financial markets and put cycle-sensitive copper prices on the defensive. Silver may be more difficult to forecast, though in the current environment if the outlook for the economy is gloomy, it could suffer.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter