Australian Dollar Analysis and Talking Points

- AUD/USD | Largest Weekly Gain in 2-Months

- Australian Dollar Technical Outlook

AUD/USD | Largest Weekly Gain in 2-Months

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

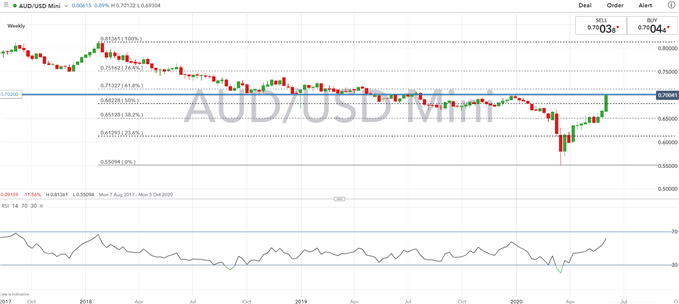

USD selling has been the main theme throughout the week, as the reflation trade kicks in. Equity markets have remained buoyant despite the persistent macro uncertainties, which in turn has seen high-beta currencies supported, namely the Australian Dollar leading USD losses. In turn, AUD/USD hit its highest level since the beginning of January, having rose to a high of 0.7012, eyes now for a move to 0.7020 to offer resistance in the pair. While the pullback in the US Dollar may seem somewhat stretched, momentum has shown little signs of abating.

Australian Dollar Technical Outlook

Momentum remains skewed to the upside, particularly as equity markets trend higher. While the risk of a short-term correction has elevated, the absence of a reversal in risk a sentiment has kept AUD/USD afloat. In turn, a break above 0.7000 opens room for a test of the YTD high at 0.7020. Dips likely to find support from 0.6900.

Implied Weekly range (0.6870-0.7140)

| Support | Resistance | ||

|---|---|---|---|

| 0.6950 | - | 0.7000 | - |

| 0.6926 | 100WMA | 0.7020 | YTD High |

| 0.6900 | - | 0.7050 | - |

AUD/USD Price Chart: Daily Time Frame

Source: IG Charts

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX