S&P 500 INDEX SINKS AS STOCKS TUMBLE, US DOLLAR PRICE OUTLOOK & VIX ‘FEAR-GAUGE’ BOLSTERED BY FED CHAIR POWELL PUSHBACK ON NEGATIVE RATES

- US Dollar climbs as FOMC officials voice opposition to the prospect of negative interest rates

- VIX Index jumps alongside the selloff in stocks that drove S&P 500 price action lower

- Fed Chair Powell speech likely contributed to a rise in risk aversion

Market volatility shows potential of snapping back higher and weighing negatively on trader sentiment once again. This follows a speech from Fed Chair Jerome Powell who voiced resistance to the idea of implementing negative interest rate policy, or NIRP, in the United States.

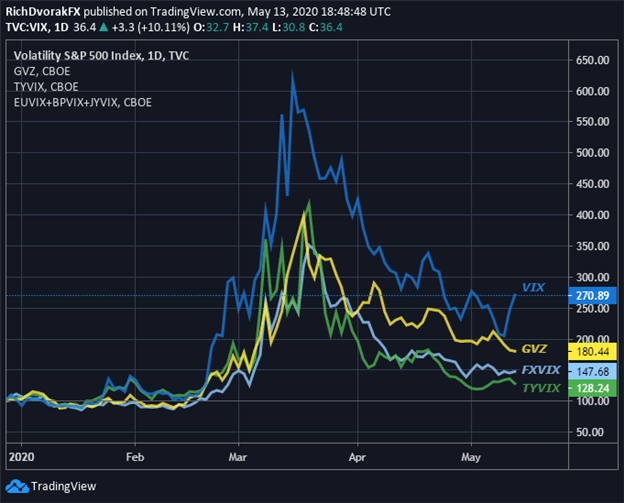

VIX INDEX ON THE RISE, CROSS-ASSET VOLATILITY STILL SUBDUED (CHART 1)

Chart created by @RichDvorakFX with TradingView

According to Chair Powell, the Federal Reserve holds a unanimous stance against adopting negative interest rates currently. Powell also added that NIRP, an unconventional tool implemented by various central banks to combat the last financial crisis, is not an option that the FOMC is looking at.

The S&P 500 Index tumbled lower in response to the news seeing that investors likely hoped that the Federal Reserve would keep drowning the stock market with increasingly accommodative monetary policy. Congruently, equity volatility, measured via the S&P 500 VIX Index, spiked higher while safe-haven assets caught a bid.

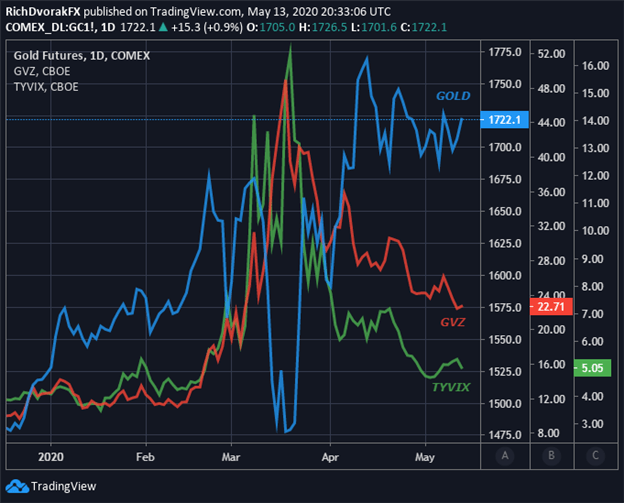

US TREASURY YIELD, GOLD VOLATILITY LITTLE CHANGED POWELL SPEECH ON NIRP (CHART 2)

Chart created by @RichDvorakFX with TradingView

Gold gained nearly 1% on the day even though recent Fed rhetoric echoed opposition to the prospect of using negative interest rates as a way to stimulate the economy. Perhaps the unencouraging tone from Fed Chair Powell helped provide a boost to anti-risk assets like gold.

The Federal Reserve leader stated how the economic recovery from the likely unavoidable coronavirus recession “may take some time to gather momentum, and the passage of time can turn liquidity problems into solvency problems.”

Powell also highlighted how the central bank might need to do more by providing extra monetary stimulus, which could partly explain the latest rise in gold prices. The precious metal churned higher alongside a slight uptick in gold volatility (GVZ) as well.

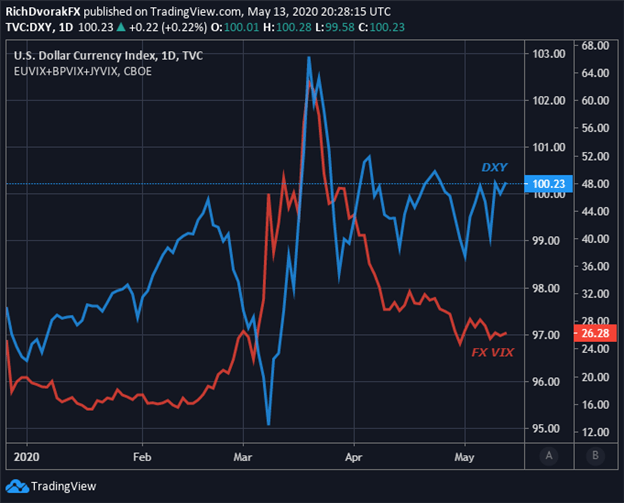

US DOLLAR INDEX, FX VOLATILITY SUPPORTED AMID LINGERING RISK AVERSION (CHART 3)

Chart created by @RichDvorakFX with TradingView

The US Dollar jumped after Powell rate outlook indicated that adding negative interest rates to the Fed policy toolkit is not under consideration. Meanwhile, expected currency volatility (FX VIX) looks like it is attempting to stabilize after a sizable retracement lower since surging earlier this year.

This has potential to keep the US Dollar and broader DXY Index bolstered – especially if investor risk appetite deteriorates further. Although, it is worth noting how the Federal Reserve has a history of capitulating to dovish market expectations.

As such, bond traders could attempt to force the hand of the FOMC, just as they did by pricing the ‘mid-cycle adjustment’ last year, and lead the central bank to set a negative target Fed funds rate. This could present a bearish headwind to USD price action.

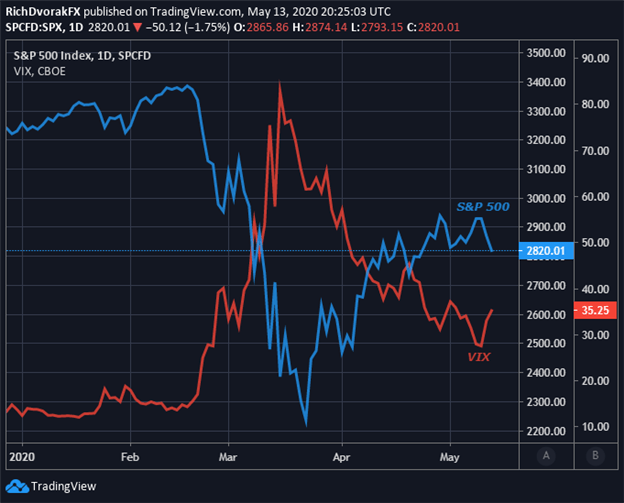

S&P 500 INDEX PRICE PRESSURED LOWER AS STOCKS STRUGGLE TO EXTEND ADVANCE (CHART 4)

Chart created by @RichDvorakFX with TradingView

In addition to Powell’s pushback on negative interest rates, the Fed Chair commented how the recently implemented emergency tools will be unwound once the coronavirus crisis is in the rearview mirror. The thought that investors may have to say goodbye to the abundance of Fed liquidity currently being provided, which calmed market turmoil, restored market stability, and helped steer the S&P 500 Index roughly 30% above its year-to-date low, likely contributed to the selloff in stocks.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

That said, it seems like there is a material possibility that the S&P 500 Index might face further selling pressure despite the recent volatility squeeze. Bearish stock market outlook is also underpinned by the sell in May anomaly, which has found confluence with underrated coronavirus recession risk and rekindled US-China trade uncertainty as Trump talks tariffs.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight