NFP REPORT APRIL 2020 – US DOLLAR, GOLD PRICE & DOW JONES INDEX

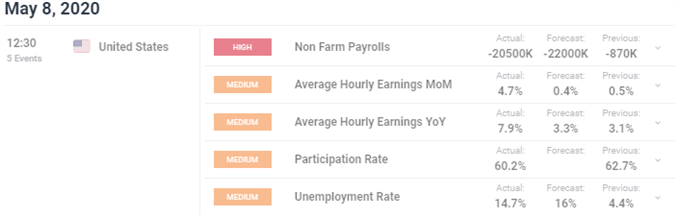

- Nonfarm payrolls (NFP) for April 2020 just crossed the wires and showed the US unemployment rate at a gut-wrenching 14.7%

- US Dollar and gold price action responded positively on the back of heightened safe-haven demand

- Dow Jones Index and broader stock market could unwind recent gains as companies continue slashing jobs amid the coronavirus recession

US NFP data for April 2020 highlights the paralyzing impact the coronavirus lockdown has had on the global economy, and underscores the likely unavoidable recession caused by the pandemic. The monthly net change in nonfarm payrolls just crossed the wires at -20.5 million while the unemployment rate spiked to 14.7% for the repored period.

NONFARM PAYROLLS & US UNEMPLOYMENT RATE - APRIL 2020

Markets were little changed in response to the eye-popping economic data considering the terrible NFP report was largely anticipated by traders. This is considering weekly initial jobless claims data has widely indicated the monumental collapse in employment and is considered a 'leading' variable relative to NFP data. Nevertheless, April 2020 nonfarm payrolls data topped market expectations.

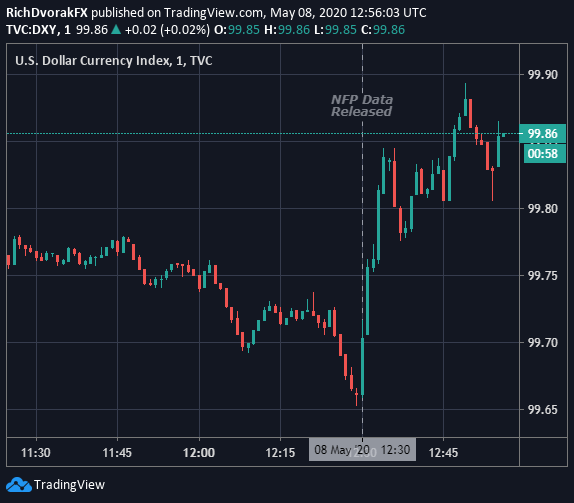

US DOLLAR - DXY INDEX PRICE CHART: 1-MINUTE TIME FRAME (08 MAY 2020 INTRADAY)

The US Dollar, measured via the DXY Index, popped modestly higher to trade flat on the day. US Dollar strength stands out most when observing spot USD/JPY price action with the Dollar-Yen up more than 30-pips since the NFP report crossed the wires.

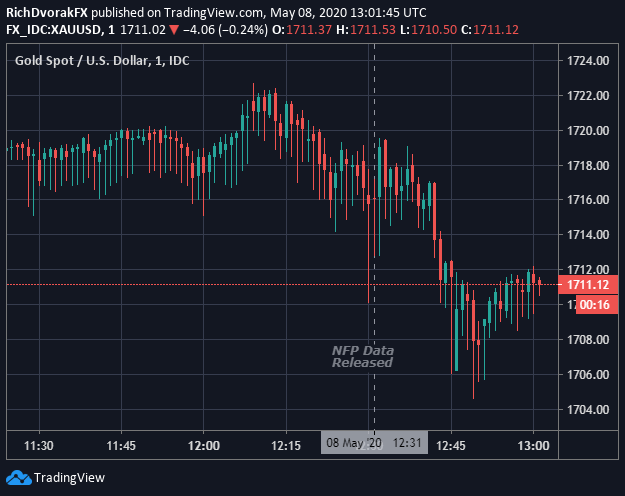

GOLD PRICE CHART: 1-MINUTE TIME FRAME (08 MAY 2020 INTRADAY)

Gold prices ticked marginally lower following the nonfarm payrolls data, but the precious metal appears to have found interim support around the $1,705 area.

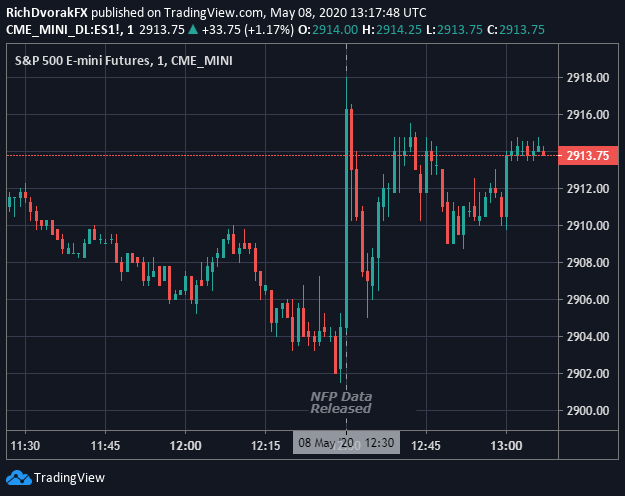

Shifting focus to equities, US stocks started to give back gains notched in the overnight session prior to the nonfarm payrolls data release according to S&P 500 Index Futures. Since the NFP report, however, the stock market has regained upward momentum with the S&P 500 trading back above the 2,900 price level.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

DOW JONES, S&P 500 INDEX POP FOLLOWING APRIL 2020 NONFARM PAYROLLS DATA RELEASE

Other major equity benchmarks like the Dow Jones and Nasdaq look set to follow suit with the three indices primed to pop about 1% across the board at the New York opening bell. Looking forward, traders will likely continue placing focus on the monetary policy and fiscal stimulus responses to offset economic fallout from COVID-19.

Additionally, US-China trade war uncertainty might return if President Trump turns hawkish ahead of the upcoming election, or if the Chinese fail to make good on their pledged purchases of US goods outlined in the phase one trade agreement.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight