Dow Jones, S&P 500, Wall Street, US Dollar, Trade War, Coronavirus – Asia Pacific Market Open

- Dow Jones at risk following Trump retaliatory tariff threats against China

- Haven-linked US Dollar gained, may rise further if sentiment deteriorates

- Amazon and Apple shares declined in afterhours trade after earnings data

Dow Jones, S&P 500 Sink as US Dollar Gains After Trump-China Tariff Threat

The Dow Jones and S&P 500 could be vulnerable following a pessimistic day on Wall Street, opening the door for the haven-linked US Dollar to recover some lost ground. During the North American session, reports crossed the wires that the US was crafting retaliatory steps against China over how the nation handled the outbreak of the coronavirus.

After the Dow Jones and S&P 500 closed -1.17% and -0.92% lower respectively, President Donald Trump said that he could use tariffs in response to China. This seemed to reignite fears of a trade war at a time when global growth is being ravaged by social distancing measures to help cope with the coronavirus. Wall Street futures pointed notably lower heading into Friday’s Asia Pacific trading session – see chart below.

Further compounding the deterioration in sentiment were downbeat earnings reports from tech giants Amazon and Apple. Their stocks are down about -4.79% and -2.48% respectively in afterhours trade. Amazon warned of possible losses in the second quarter as earnings missed estimates. Apple meanwhile did not offer forward guidance as earnings did beat expectations.

Confirmed US virus cases grew 3.83% over the past 24 hours, the most in almost a week. It was reported that after easing social distancing guidelines, Texas confirmed over 1k infections which was the most since April 10. The markets may have interpreted that as a risk from the standpoint that if cases continue growing, lockdown measures could be reinforced and thus prolonging the drag in economic activity.

What are some unique aspects of trading forex?

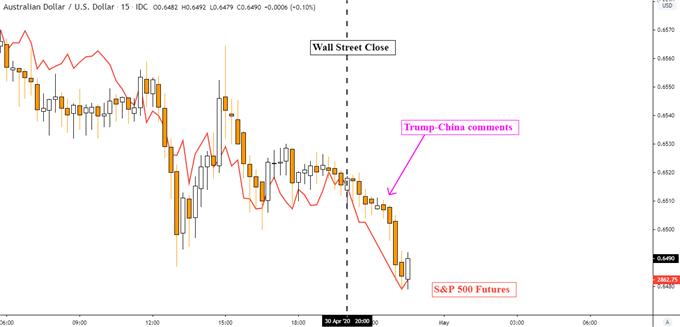

S&P 500 Futures and AUD/USD Sink on Trump-China Tariff Threats

Chart Created in TradingView – Wall Street Index Averages: S&P 500, Dow Jones and Nasdaq Composite futures

Friday’s Asia Pacific Trading Session

Dow Jones and S&P 500 futures are pointing notably lower heading into Friday’s Asia Pacific trading session. That could spell a somewhat pessimistic tone to come, placing the Australian Dollar at risk. This may also bode well for the US Dollar while boosting the Japanese Yen. A lack in prominent economic event risk places the focus for foreign exchange markets on market mood.

Wall Street Technical Analysis

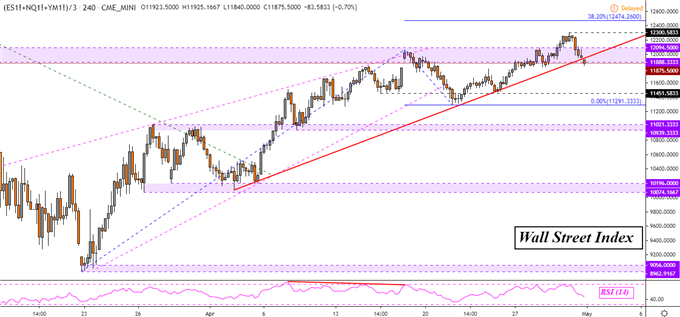

My Wall Street index – which averages S&P 500, Dow Jones and Nasdaq Composite futures – is attempting to break under key rising support from early April – red line below. This follows a false breakout through resistance at 12094. A drop through 11888 with confirmation could open the door to a reversal towards 11451. If this is the case, there could be a deterioration in broad market sentiment ahead.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -5% | 1% |

| Weekly | 7% | -10% | -2% |

Wall Street Index – 4-Hour Chart

Chart Created in TradingView – Wall Street Index Averages: S&P 500, Dow Jones and Nasdaq Composite futures

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter