WTI Crude Oil Talking Points:

- It was a brutal start to the week for crude oil as prices fell below $1/brl.

- While both the supply and demand side of crude oil remain fairly pessimistic, this move is likely being driven by something else, as future month deliveries didn’t follow the sell-off to the same degree.

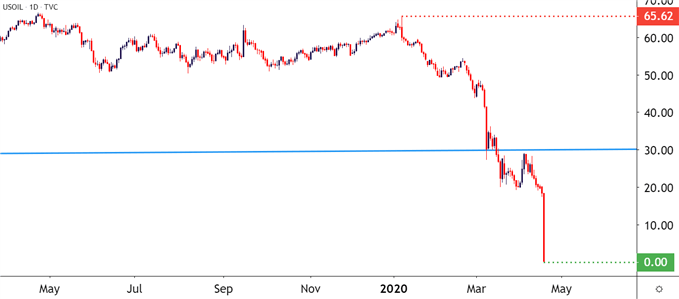

Crude Oil Carnage as WTI Pushes Below $1/brl

It’s been a rough year so far for crude oil, even after coming into 2020 trade with a quick spike of strength on the back of increasing tensions between the US and Iran. After a quick flicker above the 65-handle, it’s pretty much been a one-way-show with prices continuing to sell-off for much of the time since. And today – a new low was set; as in a new multi-decade low as prices spilled down to below $1/brl.

WTI Crude Oil Daily Price Chart

Chart prepared by James Stanley; Oil on Tradingview

While both the fundamental and technical backdrops are still pessimistic around crude oil, this morning’s move in WTI may be gaining stream from a major fund or market player blowing up and being forced to liquidate positions. This is taken largely from the observation in futures markets where the next forward contract, for June delivery, didn’t follow the same sell-off that was seen in the current month contract for May delivery, at least not to the same degree of aggression.

Making matters more befuddling – this all happens after the OPEC+ cuts that were announced last week. And while largely disappointing, with those cuts coming in on the lighter end of market expectations, there would be little from a fundamental perspective to explain this morning’s deluge in price action, thereby pointing to the fact that there’s likely something else going on here, and traders and investors would likely want to proceed with caution.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX