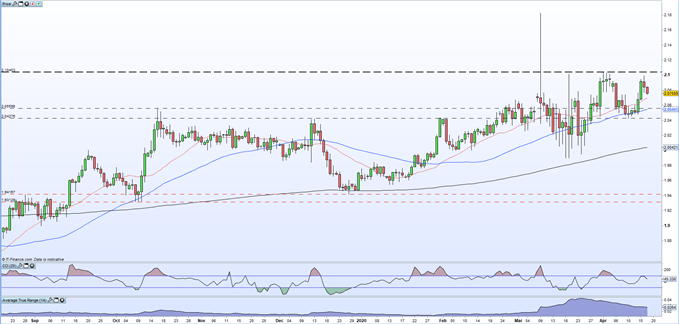

GBP/NZD Price, Analysis and Chart:

- GBP/NZD pairing weekly gains but still in positive territory.

- Higher lows underpin bullish sentiment.

GBP/NZD – Short-Term Sell-Off May Offer Longer-Term Gains

Sterling continues to press higher against the New Zealand dollar with the pair supported by a set of higher lows going all the way back to December 2018 when GBP/NZD traded at a low of 1.8127. Recent price action shows the pair moving two steps forward and one step back and upward momentum is likely to remain in place until this trend is broken by trading below 1.9900. Guarding this level is the April 10 low at 2.0428. If GBP/NZD is to break lower then it will also have to trade below all three moving averages at 2.0690 (20-dma), 2.0534 (50-dma) and the long-term 200-dma at 2.0042.

A break through all of these levels will need either a major fundamental driver or a sharp change in sentiment. As it stands, a minor sell-off followed by a larger rally over the near-term looks more likely, setting up the pair to re-test the early April double-high at 2.1040. Above here the only point of reference is the March 9 spike high at 2.1830, a target that may prove difficult to break in the short- to medium-term.

GBP/NZD Daily Price Chart (August 2019 – April 17, 2020)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBP/NZD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.