EUR/GBP Price, News and Analysis:

- EUR/GBP has shed 7% of its value in less than two weeks.

- Support may start to kick-in soon.

EUR/GBP Sell-Off Nears Potential Support

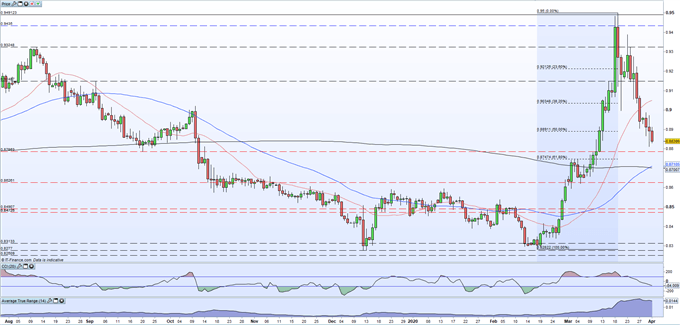

A seven percent fall in less than two weeks in a major currency pair should interest traders, especially when bearish arguments can be made for both currencies. EUR/GBP made a spike high of just under 0.9500 on March 19 before slumping all the way back to yesterday’s low print of 0.8812. Both the Eurozone and the UK remain in sway to the coronavirus pandemic, with the number of infections and fatalities rising on a daily basis. Officials on both sides see this situation getting worse before it gets better, weighing heavily on economic output and demand.

EUR/GBP now nears a cluster of technical indicators and a short-term trading area and the latest sell-off may soon slow. A short-term Fibonacci set-up of the February 18/March 19 rally highlights the important 61.8% retracement level at 0.8747, just above the 50-dma at 0.8710 and the 200-dma at 0.8700. These two crossed on Tuesday, forming a ‘golden cross’, a bullish medium- to long-term indictor. In addition, the CCI indicator is nearing oversold territory for the first time in a month. There are also a cluster of recent candles between 0.8600 and 0.8750 that need to be overcome if negative sentiment is to persist. Fibonacci retracement at 0.8891 (50%) and 0.9035 (38.2%) should cap any upside break for now.

The DailyFX Online Trading University has 1000s of updated articles covering all aspects of trading.

EUR/GBP Daily Price Chart (October 2019 - April 1, 2020)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.